On March 10, many of us heard the failure of the sixteenth largest financial institution in the United States at breakfast with the radio on. They say Silicon Valley, the name of the bank. It didn't look very serious, it's not 2008, it's not the Lehman Brothers explosion. But as the day and week progresses, the financial market has been seen.

Two days later, Signature Bank, the largest crypto bank in the United States, and First Republic followed the path of the former. A week later the crisis reached Europe and the 167 year old bank Credit Suisse had to ask for a rescue from the Swiss central bank. Days later, on 24 March, the huge German financial company Deutsche Bank vibrated with 15% of its shares…

What is this? Are we back in 2008? Many have the feeling of living a kind of déjà vu, not without reason: “One thing has become clear, fifteen years after the bankruptcy of Lehman Brothers, everything can happen again,” says Finance, the roue carrée (Financial, square wheel), published by Le Monde Diplomatique in April.

According to a bolus study since mid-March, 186 US banks are in the same state as Silicon Valley Bank

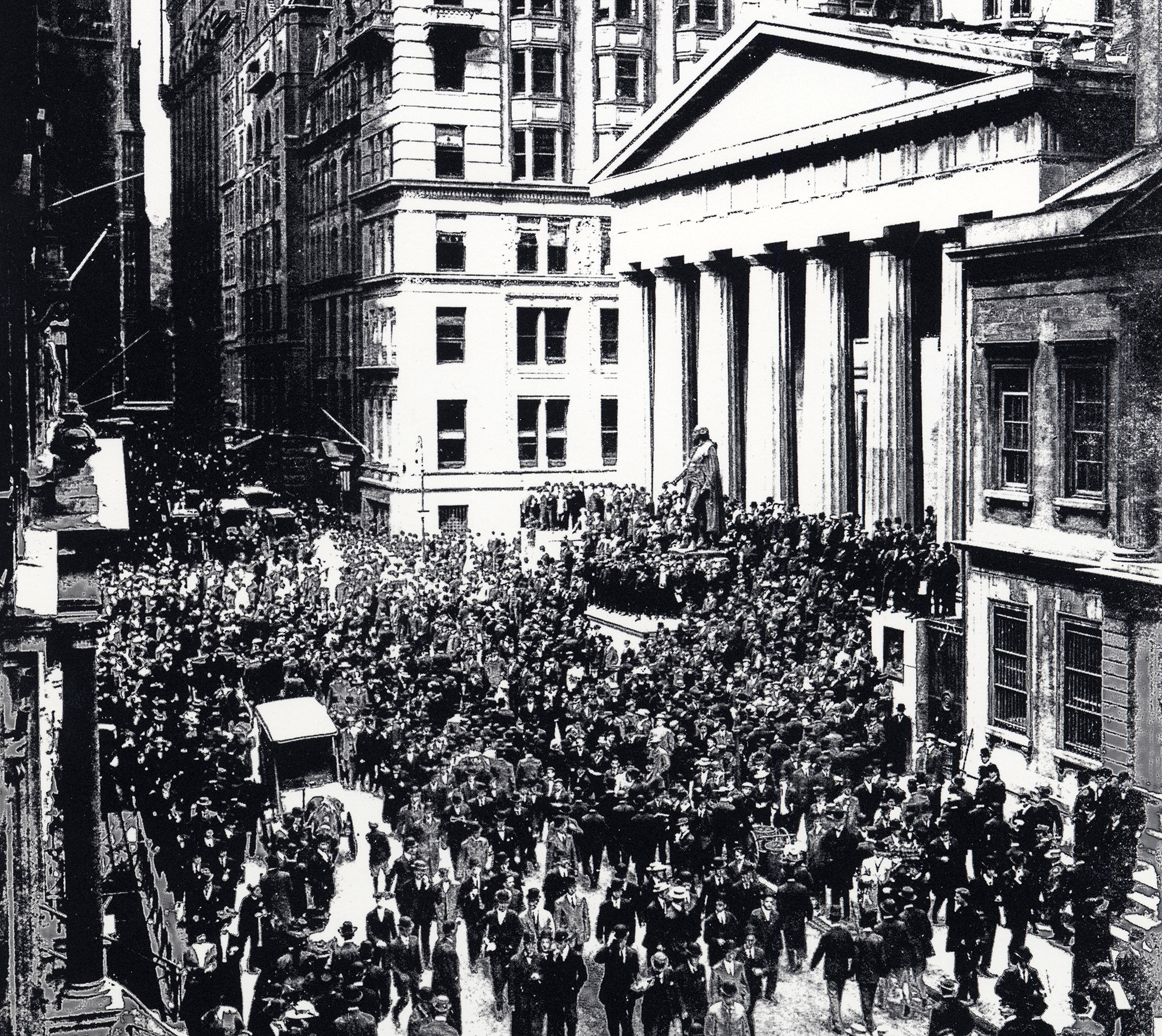

The collapse of the Silicon Valley Bank (SVB) has been triggered by the sharp rise in interest rates initiated in recent months by the Federal Reserve System, apparently because this bank had its assets invested in long-term treasury bonds and all customers had pulled out their deposits running as they saw that they were losing profitability with the rise in rates. They call it Bank run, who know about these things.

But the US Government has acted quickly as a firefighter. It has launched a financial programme for bank support, using public bonds as collateral, and has secured deposits to customers, not only those who have savings of up to $250,000, but all who exceed it! In Switzerland, the tap has also come from public bodies: the national bank has injected CHF 100 billion into Credit Suiss to facilitate merger with its competitor ACS.

Public money will then be used to save the rich, who has in his account more than 250,000 dollars? Another component of déjà vu. But everything is fine, according to the authorities, the control mechanisms put in place since 2008 have worked: “Don’t worry, your funds are safe,” Biden will say. “Pas de problème, our system is strong,” Lagard.

However, a report (pdf) that has been flying since mid-March makes little sense to be calm. Published in the Social Science Research Network portal, with this name serious even less enthusiasm, the study warns that the value of American bank assets – assets, guarantees and solvency – can be almost two trillion dollars less than what appears in the accounting books, due to the increase in interest rates in the last year. According to this, 186 US banks are in the same state as SBV.

“The underlying reason for the US financial crisis should be the deregulation driven by the authorities, due to the weakening of control over smaller banks.” This is what Andreu Missé, director of Social Alternatives, says in his article “Lessons from a new debacle.” The former head of the economic section of the newspaper El País for many years has recalled that five years ago the United States Senate took steps to “soften” the Dodd-Frank law. This law was created after the shock of 2008 to sharpen the rules and avoid another financial disaster. In the 2018 debate, “among supporters of demanding less from banks, Jerome Powell, current president of the U.S. Federal Reserve,” the Catalan journalist says in his article.

But in addition to Powell and his colleagues in the Republican Party, seventeen Democratic Senators voted for deregulation of the Dodd-Frank Act. And we have now learned that behind that decision was bank pressure, including that of the SVB and Signature Bank banks.

When the train leaves the lanes

The journal The Lever, specialized in investigative journalism, has published the subsession of the financial sector in the sewers of the American Senate to condition political decisions. The announcer, columnist and filmmaker David Sirota recently founded The Lever, formerly called The Daily Poster. Sirota is known in the movements of the left of the United States, among which is the edition of Marxist magazine Jacobin and the speeches of Bernie Sanders, a candidate for the White House.

To soften control over banks, Silicon Valley Bank bought the vote of Democratic Senators, collecting some and using other revolving doors.

The Lever has broken down into several articles the conduct of SVB and Signature Bank: SVB Chief Pressed Lawmakers To Weaken Bank Risk Regs (“the SVB leader pressured jurists to soften the rules of risk for banks”), one of them has titled. Sirota himself tells journalist Amy Goodman the core of the study Democracy Now! “SVB President Greg Becker spoke at the U.S. Congress as they were studying the deregulation of the Dodd-Frank law,” says the speaker. To inexorably pass the stress tests, a bank recommended that instead of having assets over $50 billion, it should exceed $250 billion, “and they did, because they raised the barrier.”

To do so, SVB acquired the Democrats’ vote, with recollections from one, using revolving doors from the other. How to understand it if not, Senator Barney Frank himself, who drove this law, left office and sat on Signature Bank chairs? According to The Wall Street Journal, he also pressured from the bank that has now failed to do a bit beyond its law. “If this is put in a corruption film, the screenwriter would say the front would be too big, which is a ridiculous,” Sirota told Goodman.

But unfortunately it's not an isolated phenomenon, and The Lever's creator compares politicians' behavior with another event: on February 10, a train carrying toxic substances in the American state of Ohio left the lane and suffered a serious explosion. Years earlier there were similar accidents in rail transport and standards tightened, but then the chemical industry got trains like Ohio not to be labeled “high-risk” and the law changed again.

“There is a push – says Sirota – to regulate when crises occur. But then people forget, or politicians wait for people to forget, and then comes another push for deregulation.”

.jpg)

Private or public banking?

So what's the way? This is the question that the Marxist economist Michael Roberts has asked in a long post written in the blog The Next Recession, the Spanish version of the CADTM, translated by the portal No Permission, in favor of the abolition of the illegal debt that we have mentioned many times in these pages.

“This is already a great crisis, easily comparable to that of 2008,” says the author. Some believe that higher standards are needed, such as the Nobel Prize for Economics, Joseph Stiglitz, but Roberts is not so convinced that “regular doesn’t work, bankruptcies continue.” In this monetary capitalism, banks are continually breaking the rules of the game and, as in 2008, it says that regulators have failed. It believes that the only option is “to transform modern banks into a public service, such as health, education or transport”.

The truth is that we are not far from there, and the prestigious Chief Editor of the Financial Times, Martin Wolf, has also recognised it in one of its pillars: since the 2008 crisis “the banking system has become part of the state as a whole and unambiguously.” But as Roser Espelt says in the opinion section of this issue of ARGIA, the ability to decide what to fund remains in the hands of doped banks.

Meanwhile, “Quiet, Kutxabank is safe,” Azpiazu will also tell you… And if not, it will always remain, when the next explosion occurs, to reregulate as previously deregulated.

Arma nuklearren produkzioarekin, mantentze lanekin eta modernizazioarekin loturak dituzten hainbat enpresa aztertu dituzte, eta horien artean agertzen dira BBVA, Santander bankua eta SEPI.

Frankismoa ez zela 1975ean amaitu diktadoreak ohean azken hatsa eman zuenean, hori badakigu. Erregimenaren haziek bizirik iraun zuten poliziaren tortura ziegetan, justizia auzitegien sumarioetan eta militarren zein politikarien deklarazio kolpistetan –Aznarrek azkenaldian... [+]