Right to a dignified life

- If you live more than a year in Bizkaia, Gipuzkoa or Araba and are over 18 years old, you will be entitled to a maximum of 900 euros per month, without further requirements. EUR 450 for citizens aged 4 to 18 and EUR 270 for children under 4. Would you agree? In principle it seems difficult to reject such an offer, but is it real or are we talking about a story? On 5 May, the social initiative led the Basque Parliament to the popular legislative initiative of the Unconditional Basic Income (RBGOE), with 20,075 signatures. The PNV, the PSE, the PP and Vox rejected the debate on the issue and EH Bildu and Elkarrekin Podemos left. The aim of the proposal was to put an end to existing policies to combat poverty and to consolidate ODA so that all citizens can live in dignity. The PNV and the PSOE expressed a preference for reforming the current anti-poverty tools. The issue comes with force, has many edges and we will address them in the pages that follow.

It is not a recent issue the Unconditioned Basic Income, which also call universal basic income, among other things, the claim has been in the square for decades, but often in academic environments and without getting ideas disseminated among citizens. Now, more than ever, talk about it. In addition to the proposal to which we have referred, an extensive campaign was also conducted at European level in 2013 and a million signatures have now been collected to request that the European Parliament act as a law. The Assembly of Corsica also proposed its establishment on 9 May. We also included it in the European Parliament’s electoral programme in 2014, but not in the last elections in which it has opened its way to government. So far, the further away from government options, the more tender this basic income is driven, but it is often retracted as it approaches government options. The PS candidate for the presidency of the French State of 2017, Benoît Hamon, proposed a universal income of 760 euros for all citizens. Later the concept of section horri.Aurrerantzean will reach the basic income (RB).

There are many places where pilot experiments are being carried out, both at European and global level, including Catalonia. And perhaps Switzerland is one of the most representative indicators of the size of the issue, as in 2016 a state in the world led to a referendum when deciding whether or not it has a basic income of 2,400 euros across the country: 76% of the population refused. We will not go into the analysis of the outcome here, but the promoters were pleased that 24% of the citizens were in favour without any political party supporting the initiative.

The sponsors of the introduction of basic income in Switzerland included former Greek Finance Minister Yanis Varoufakis or Slovenian philosopher Salvoj Zizek, but also World Economic Forum President Klaus Schwab. As usual, basic income has been boosted from leftist positions, but it is not surprising the defense of the president of this forum of the richest, considering that the defense of basic income has since its inception the liberal branch and that many neoliberals known in recent years are supporting it.

On the net you can find information on the subject, and you have also fished, but above all we have used three books to wear this Larrun. Crisis and reconstruction of the welfare state of Gorka Moreno. Herritarron Basic Errenten aukerak. [Crisis and reconstruction of the welfare state. Basic Income of Citizenship Options] (Basque Government, 2008). Daniel Raventós Basic Income. Zergatik eta zertarako? [Basic income. Why and why?] (Cataract, 2021). And Julen Bollain Basic income: a tool for the future [Basic income: the tool for the future] (Millennium, 2021). The latter is the result of the doctoral thesis defended by Bollaine last year at the UPV.

.jpg)

The right of all citizens But what is it or exactly what are we talking about basic income (RB)? Basic income, regulated by law and as a right, would consist of an exact amount of money regularly and unconditionally allocated to all citizens, which could be granted year-round or distributed monthly, as is normally done with salary. Its aim is to eradicate poverty, and to do so it should have at least one poverty line equal to the amount of money set. Poor or enriching, it would be received by every citizen, without any condition, or, if necessary, it would be to demonstrate the nationality of his country. We should distinguish who is going on in a country and who has decided to stay there, and for that there may be certain conditions, such as that the citizen who wants to receive the NC should show a year's stay. There have been many small experiences in the world, but an OE like the one mentioned in any country has not yet been successful.

This LARRUN will show mainly the vision of the members of the Global Basic Income Network (BIEN), who are performing the most elaborate stimulation of basic income worldwide. In the Basque Country, the citizen initiatives that have been organized for the Basque Parliament, in the Spanish State the Red Renta Basic Network or in the French association Mouvement Français Pour un Revenu de Epsv are added to the vision of the DOS.

"Basic income, as a right and regulated by law, would consist of an exact amount of money regularly and unconditionally allocated to all citizens, which could be granted year-round or distributed monthly"

Multimodality NC systems can be implemented, but in all of them some characteristics are common. One will be made in money and not in other goods or services (food, water, electricity...). This will give the person more freedom to decide how to spend that money. Two, it is unconditional, and unlike the current systems of income from poverty, there is no need to demonstrate anything to receive it before the administration; it is demonstrated that when these incomes are perceived in conditions, a significant percentage of the population that needs them does not receive them (something we will then touch on in more detail).

The third reason is that it is universal, that is, all citizens, whether children, young or old, minors as usual and adults as well. Four, the individual, who is very important, because it is about ensuring that each person receives and not the heads of family, usually the male, with the risk of dependence this entails for the rest of the family members. And five: it will be financed by taxation, for which a profound tax reform will be carried out. Basically, the OE should allow anyone to have the minimum material goods necessary to live freely. Later on we will see some of the experiences that have been made in the world.

Why now?

Basic income has long terrones in time, but the issue has gained particular strength after the delays of the great crisis 2007-2008. Since then, the gap between the poor and the rich has widened around the world, and the ever-growing job insecurity has destroyed the sheds to live in dignity. The COVID-19 era has also pushed him because it has revealed the vulnerability of the weakest, and rarely has there been talk by law about the welfare of people and societies. In these worrying contexts, the OE wave has gained strength.

"Citizens who are out of work will need something to avoid falling into poverty and basic income is perceived as a way of sharing the wealth that robotization will entail"

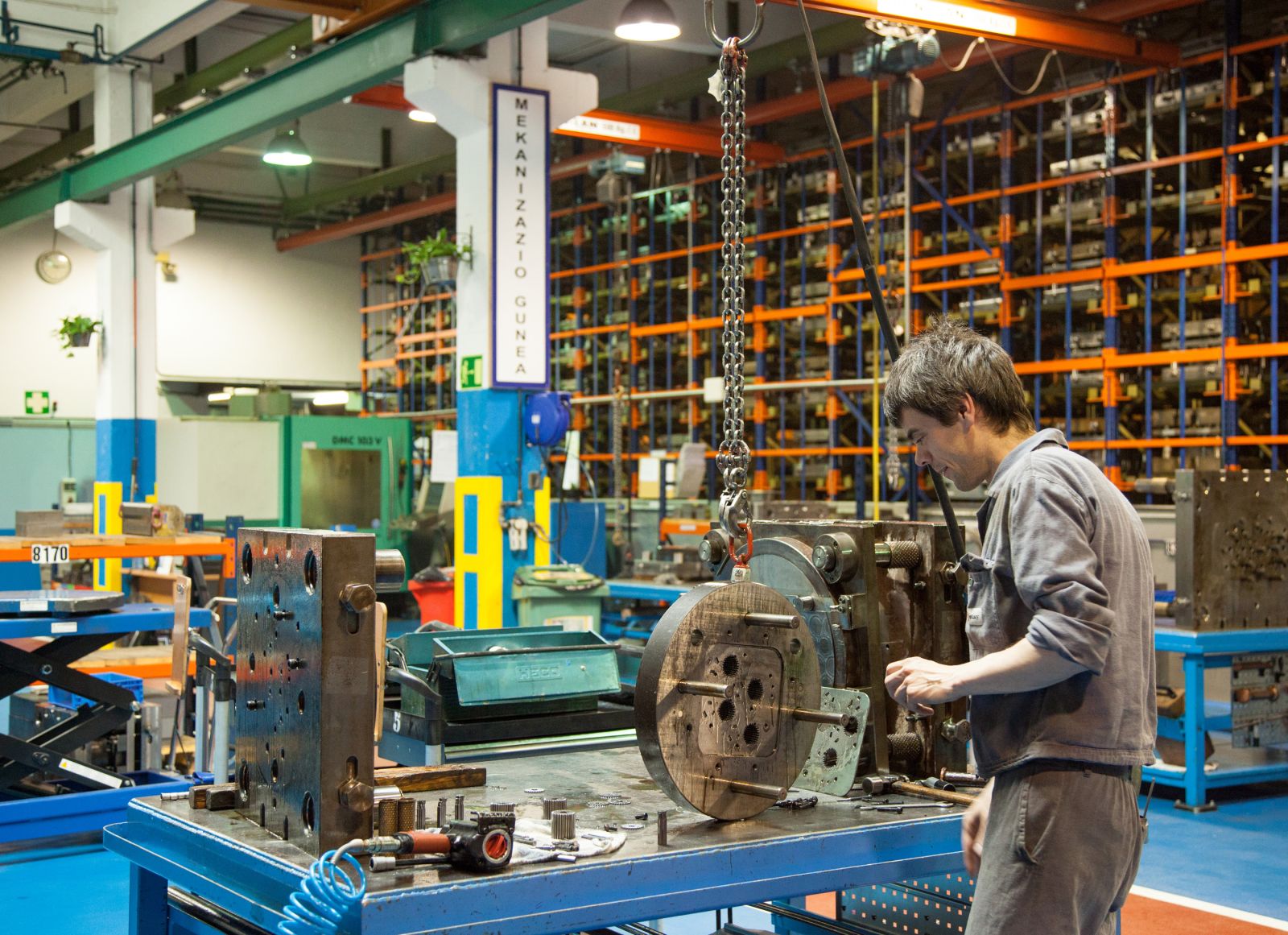

In addition, technological development and automation processes require less and less work force and employment is expected to decrease considerably in the coming years. The OE is conceived as a way of distributing the wealth that robotization will entail. In short, the emerging neoliberalism of the 1970s and 1980s continues to erode the basic pillars of the welfare society, at least in the places where it was built, and the OE would be a shield against this attack from the richest.

In any event, this should not lead to any loss of the present welfare state, as many people announce, but, in the opinion of those who defend the OE, it would be another great pillar of the welfare state to guarantee the minimum survival and dignity of people. Not even one euro of the budgets currently maintaining well-being should be used to earmark it for universal basic income.

Increasing poverty Wealth

is accumulating less and less hands globally and in developed countries the middle classes have suffered a severe blow in recent decades. However, extreme poverty has fallen dramatically globally: Between 1990 and 2015, from 1.9 billion people to 730 million people (data from digital publication Our World in Data). This improvement in the situation has occurred particularly in western Asia and the Pacific regions. On the contrary, in Africa, extreme poverty in sub-Saharan areas has continued to worsen over the years.

Having said that, it is clear that the gap between the poor and the rich is widening, especially as they accumulate more and more. Eleven research centres around the world demonstrate this. According to the report published by Oxfam in 2020, 1% of the world’s population accumulates more wealth than 6.9 billion people. In 2019, the 2.153 million people were over 4.6 billion. The world's 22 richest have more money than all African women. Or the richest 10% of the population in the Spanish state, richer than the remaining 90%.

The conditions of concentration of wealth in the hands of some are now more appropriate than half a century ago. There is also little debate here, the debate comes in proposals to deal with the situation, both on the left and on the classical right. All of this shows that there is wealth, even for a basic income, but that there are no roads and above all consensus.

Eradicating poverty is the

objective of anti-poverty policies implemented in most Western societies. A subsidy of this kind was first established in the Spanish State in 1989 at the CAPV. Consequently, currently, citizenship that meets a number of requirements receives CAPV 727 euros per month, if there are two people in the family unit or cohabitation 934 euros and 1,033 euros in units of more than three members. In Navarra the only person dominates 658 euros, 888 euros for every two people and 1,053 euros above. According to casuistic figures, there are more, but these are the basic subsidies. The Catalan professor at the Daniel Raventós University, renowned expert and promoter of OE topics, considers that the most prosperous rents of the State and one of the most dignified in Europe are those of the South. And yet, he says that they have not been able to meet the goals they had at their origin, to eradicate or alleviate poverty significantly, and that is why it is time to change those policies.

In the Eurostate 2020 data, and if the data are worse in other measurements, 20.7% of the Spanish population was at risk of poverty (13.6% in France), with Spain being the third country with the poorest of 16 years after Romania and Bulgaria. In total, it is the fifth most poverty-stricken country in the EU. According to 2019 data, in Hego Euskal Herria, 13% of the population was in poverty, the lowest figure in the state. In 2010, 80% of the Spanish unemployed had some level of economic coverage, but by 2017 this level of protection was reduced to 56%.

Daniel Raventós sees the fundamental difference between those who defend conditional incomes and basic income: liberal freedom and republican freedom. The logic of conditional aid is that both because he has been out of work and because he works and does not overcome the poverty barrier (with current data, 15% of Spanish workers), the one who has failed must be helped. This conditional aid entails a loss of freedom by fulfilling eleven requirements to access them.

On the contrary, the logic of basic income – Raventós explains – is that of the law, and it will guarantee the citizen from the outset the minimum income for the mere fact of being a citizen, that is, the wealth of the world has been produced in a social way, so it should be distributed without any exclusion: "Unconditionality is the language of human rights and citizenship, while conditionality is that of the king and of dependency." In short, he believes that freedom suffers many attacks on social life, and that the strength of these threats depends on the material conditions in which we live.

.jpg)

When the proposal for a popular initiative

on the exhaustion of the current model was presented in the Basque Parliament at the end of May, different approaches were found in the current anti-poverty policies: For the PNV and the PSE, for example, the reform being worked out will be sufficient to better meet the objectives that have not so far been met. For the promoters of the basic income initiative, EH Bildu and Elkarrekin Podemos is not enough. The latter may not agree exactly with what needs to be done, but at least they are clear that the limits of current policies must be exceeded, and that in order to know how to do so it is essential to discuss the issue and put NC on the table.

Bollaine and Raventós, in general, see five major limitations on the minimum income currently distributed: budget cuts, the stigmatization suffered by recipients of these subsidies, coverage failures, the high administrative cost of control, and the poverty trap, that is, with these policies many citizens cannot get out of that situation.

Iñaki Uribarri, a member of the ESK trade union and an observer for poverty policies at the CAPV, has now become apparent. It is also one of the OE's most active speakers in the Basque Country: "There have been no management errors, the model itself has failed." Within the Basque institutions, the policy against poverty is structured into three fundamental pillars: Income Guarantee, Supplementary Housing Benefit and Social Emergency Aid. According to Uribarri, this system excludes 30% of people at risk of poverty because they do not meet the requirements for 11 reasons, and of those who do not reach these benefits, about 52% are people in employment, "of course, very precarious employment". Half of the people receiving this aid manage to overcome poverty and the other half do not.

Several articles published in recent years in the journal Sin Allow can read these kinds of studies and evaluations, and in them it also explains where he believes that the debate on poverty policies is today and how these subsidies are being reduced. It comes to a very demanding conclusion: "The Basque Government is not prepared to put an end to poverty in the CAPV (...), it will confine itself to doing its best with the corresponding budget, and I believe that this limit is EUR 500 million." Conditions for access to aid are also harsh: "Lanbide's control of the beneficiaries of the subsidies will be extraordinarily invasive, even more bureaucratic, more expensive for the administration, increasingly illegal and defenceless."

Therefore, Uribarri is clear that an appropriate measure to overcome the current model of poverty policies would be to establish a basic income without conditions. The backbone of the proposal he developed in his intervention at the Casa de Cultura de Romo (Erandio) and which has the greatest interest can be found in the network (RBI, a very current policy / BGOI, a very topical policy).

As we know today, basic income is a matter of decades, but in the last two or three centuries similar concepts have

been seen from almost all ideologies, from liberalism, socialism, Marxism, anarchism or even neoliberalism today. There are also strong positions against the OE in all these fields. In recent years, for example, the defense of Bill Gates, one of the richest men in the world, and the adherence of Mark Zuckerberg (Facebook), the head of Amazon Jeff Bezos or Elon Muskiz, head of PayPal, SpaceX or Tesla, has drawn attention. Klaus Schwab, the creator of the Davos Forum, brings together the richest in the world. And there's one more little machine.

But this trend is not surprising, although with a different touch, because Milton Friedman himself from the Chicago School proposed in his well-known work Capitalism and Freedom to give a conditional income in 1962. And later is the Vaincre la pauvreté dans les pays riches, 1974, developed by Lionel Stoléru in France.

So can the poorest in the world benefit from the proposition of a neoliberal platoon of size? It is not easy to believe, and for those who defend the OE from the other end, under this conception of the richest underlies the desire for the dissolution of the welfare society. Iñaki Uribarri, speaking at the Casa de Cultura in Rome, stated that neoliberalism was born four decades ago with the intention of destroying the welfare society. It has destroyed a great deal, but not at all, and now has the opportunity to dismantle it completely, because for neoliberalism the welfare state is not only economically unviable, but also hinders economic growth and social progress.

According to Uribarri, in the proposals launched by the neoliberals, basic income would be destined for all citizens, and with it they would have to buy the services currently offered by the welfare society, such as health, education or pensions. The disappearance of the welfare system opens up a huge territory for capitalist investment, and its disappearance would allow taxes to be lowered. Neoliberalism attaches great importance to the loss of employment by robotization, but not in the wrong sense: "Less employment and therefore less capital gain," says Uribarri, "but that doesn't matter to capital. With greater unemployment, it has more facilities to impose on the working class the conditions it wants, that is what it is really interested in". In this direction, the economist Charles Murray's proposals were placed in one of his last books, and the title is also quite significant: In Our Hands: A Plan to Replace Welfare state Welfare state substitution plan).

So what will be the basic income that neoliberals will propose? Uribarri is clear: "Not enough to give a dignified life to the citizen, but what they expect from the calculation to pay for the aforementioned services. Our NC model is quite the opposite." The Global Basic Income Network, established in 1986, has also been located at the other end of the OE, seeing together the OE and the public services currently offered in its poverty eradication strategy.

So what will be the basic income that neoliberals will propose? Uribarri is clear: "Not enough to give a dignified life to the citizen, but what they expect from the calculation to pay for the aforementioned services. Our NC model is quite the opposite."

"And that in money? "One of the key questions when talking about basic income

is: "And that in money? ". In other words, is it possible to finance this type of income from the perspective of our current Western society? For a correct answer, one of the most important would be the amount of the CN to which we refer, since it is not the same as EUR 650 as EUR 980. Many studies have been carried out, and funding is possible. Most of the studies carried out would cover the cost – or "investment", say NC supporters – tax, and there are several proposals for this.

In 2017, Catalan economists Jordi Arcarons, Daniel Raventós and Lluís Torrens published an exhaustive statistical study with a detailed proposal on the OE. We used the data provided by the Tax Research Institute of Spain, a sample of almost two million statements declared in 2010 in the area of Personal Income Tax (IRPF), in which the CAPV and Navarra were not taken into account, because these territories have their own tax system. He himself explains the proposal in his last book. Until 2021, these data have been completed with research carried out on the data provided by the Spanish State Tax Administration Agency. For example, the work done by Mondragon Unibertsitatea professor Julen Bollain has been added to them. We have used the book written by the latter – Basic Income: a tool for the future – to present the financing proposal here.

What is the consequence of wealth distribution? In the new situation, 75% of the population will receive more money than they had and 25% less, that is, the latter will finance the NC from the previous ones.

As specified in the study, 43.7 million people should receive the RB in Spain, of which 34.3 million people were examined in this study the income statements. In other words, 9.4 million citizens were excluded from the examination because they had not made a tax return. How did you calculate the amount for basic income? In the European Union, the poverty barrier stands at 60% of the average income of the population, and this, translated into the time of 2010, when the IRPF is at that time, the OE would be EUR 7,471 for adults of the year, EUR 622.5 per month, and EUR 1,494 for children of the year.

OE has three main characteristics. First, this income will replace the subsidy received for any other reason, provided that it is higher than the one previously received, and if it is lower, the difference in money will be obtained up to the corresponding subsidy, i.e. the one it received. The RB will suspend all subsidies currently granted by the State, resulting in savings of EUR 92,222 million. Secondly, the money received from the RB is tax-free. And thirdly, the OE is self-financing, that is, it does not affect the current state budgets. In the latter point, the OE supporters place a great deal of emphasis, as the opponents argue that large amounts would be diverted from other areas of the State to finance the OE.

Therefore, to finance the basic income of the 9.4 million people left out of study, EUR 62.954 million is needed, and as there are EUR 92.222 million saved by the elimination of the remaining subsidies, there is still a surplus of EUR 29.367 million. In addition, to finance the income of another 34.3 million people, EUR 288.044 million is needed. To achieve this, a tax reform will be carried out and a single rate of income tax will be applied to all income (small and large) of 49%. What is the consequence of wealth distribution? In the new situation, 75% of the population will receive more money than they had and 25% less, that is, the latter will finance the OE of the previous ones. If we include in the proposal the 9.4 million people who have not entered the sample, the result is similar and the richest 20% of the population will finance the remaining 80%. A proposal that will eliminate poverty and place the Spanish State among the most egalitarian countries in the world.

On the basis

described, with corrective measures, the cited economists have made other proposals since 2017, this time with updated data and, above all, with mechanisms for correcting the various collateral damages that occur in the basic general proposal. They make three proposals. The first is for no one to lose 80% of the families with less, with an income of 8,815 euros – the poverty barrier – and a single rate of income tax of 46.83%: Financing this model requires €50,656 million (4.3% of GDP). 80.8% of families remain as winners or before and 19.2% lose income compared to the situation before the entry into force of the RB.

The second proposal is EUR 8,400 per year for adults and EUR 1,680 per year for minors. The aim of the amendment is that none of the citizens with less than 80% of work lose anything. The type of income tax is 49.05% and the proportion of losers and winners is similar to the previous model. EUR 76,739 million, 6.5% of GDP. And they relate the third proposal to the minimum income of residence: 491 euros for adults and 29.19% of income tax with a single type. It needs a total of EUR 26.671 million (2.2% of GDP) and, of course, has fewer consequences for levelling objectives. Only 12.3 per cent of households are losers. According to Bollaine, the transfer of income between men and women in these three models should be highlighted, especially in the second (EUR 18.745 million) and the first (EUR 13.483 million).

Analyzing 450,000 income statements from Gipuzkoa, Professor Arcarons concluded that it was feasible for every elderly person in the country to receive 658.5 euros per month and the smallest 131.7 euros. Calculations are made at the single rate of 40.52% of IRPF

During the administration of Gipuzkoa’s Deputy by EH Bildu (2011-2015), at the symposium on basic income Professor Jordi Arcarons gave an account of the research carried out on behalf of the foral institution. The economic differences would be 2.5 times less than the progressive IRPF per hour and would improve the economic situation of 75% of Gipuzkoans. Funding for this NC required EUR 4,857 million: EUR 1,518 million are currently derived from the benefits received by citizens and the rest of the tax reform.

In any case, NC supporters argue that these amounts should not be seen as expenditure but as investment, and that, in addition, these amounts would be lower than those appearing. According to the study conducted by American researcher Scott Santtens, the total cost in the model studied was 3 billion dollars, but the final cost was 900,000 million dollars. In short, according to Santtens, citizens would have better health, there would be less crime, fewer citizens in prisons... and this would reduce state spending in eleven areas. I mean, as he says, "poverty doesn't come out for free."

We have not mentioned all

the arguments in favour of the OE against the OE and we will do the same with the opponents, who are many and very diverse. In capitalism there are voices in favour of the OE and, as we have seen, not of any kind. In general, however, the NC would be detrimental to society for liberals. It would promote laziness and parasitism, harming the whole of society (there are also positions on the left). In general, they consider on the right that it is not true to think that the RB would increase the income of the majority of the population and that in the economy everything would remain the same. According to the liberal journal The Economist, such a project would have important consequences in prices, wages, work organization, production, competitiveness and economic growth. The NC could only be paid with a strong tax increase, which would lead to significant economic distortions.

In general, however, the NC would be detrimental to society for liberals. It would promote laziness and parasitism, harming the whole of society (there are also positions on the left)

On the basis of republican justice, Daniel Raventós puts a lot of strength in defending the NC as a fair system. For the neoliberal economist, Juan Ramón Rallo, at the other end, OE "is absolutely unfair." Rallo wrote in 2015 the book Against Basic Income in which he explains why OE is unfair: "Because it allows every citizen to take on a part of what other citizens have produced." It considers that the citizen must seek his way of life, and in any case, as a last step, the State should have the last support as minimum income.

What about migrants? What about the effect called? As could not be otherwise, anti-RB attitudes could not lack xenophobic arguments that repeatedly appear in the debate on minimum incomes and subsidies: "If we give them a base salary, all citizens of developing countries will come." For example, if we look at the Spanish state, this has not happened in the CAPV, although the Income Guarantee Income of this community is the best in the state. Migrants travel to places they think have jobs for them, thinking they will work there.

Therefore, in the light of this background, it could be thought that the OE should not produce this so-called effect either. In any case, the wealth of Western societies makes a lot of effect called through the world, and few say that to avoid that so-called effect you have to dismantle that wealth. However, those who promote the measure in the European Union feel that it would be better for basic income to be put into effect throughout the EU than in a single state.

On the left in general, criticism has more to do with the breakdown of the culture of the binomial employment/income. In other words, the rights acquired in modern society have been derived from the culture of work and the struggle of workers, and it is impossible to think that the freedom and autonomy of the person will be achieved disconnected from the world of work. This concept is deeply rooted in the trade union world and, as Iñaki Uribarri says, the CSR has been the only trade union that has firmly defended the NC among the Basque trade unions. It considers it essential to discuss the matter with the Basque trade unions and to unify positions. And perhaps the fairest thing is to mention employment where work has been said, because many or most of the world's works are not paid, like reproductive work.

Drawbacks of the trade union world

In Raventós's accounts, reluctance or anti-union attitudes are summarized in the seven following reasons, although they are not written anywhere. After each of them we will add a replica of Raventós to show the trajectory of the debate. One, with the RB, the worker can gain strength because he is in a better position to choose a job, but that same reinforces individual positions and weakens the collective, the unions can lose collective strength, that is, the RB can favor non-solidarity and promote individual solutions. Raventós: besides reinforcing the worker's position vis-à-vis the capital, in case of prolonged strikes can be an OE resistance fund.

Two, given that the majority of union members have a fixed labour agreement and higher salaries than at present, they may lose out in the tax reform demanded by the RB. Lagos: The old stable contract no longer exists, and the vast majority of trade union members would win in our NC proposal [we have explained before]. Three, the OE can be used to dismantle the welfare society. Lagos: Yes, that is what the right-wing advocates of the OE want, so we must distinguish between them and our NC proposals, and not think that all NC are the same.

Fourth point. Employers will use the RB to reduce wages on the pretext that some of the wages are covered. Lagos: Yes, entrepreneurs will try, but this argument has huge gaps. With the same argument, in Italy the trade unions did not want an inter-professional minimum wage, but in countries where this minimum wage exists it prevents employers from using the OE to reduce wages. Five, the OE is opposed to the culture of hegemonic employment so far. Lagos: Yes, the OE does not link employment and rights, it is neither antiemetic nor incompatible with it. It offers the possibility of reducing the number of working hours for leisure or other activities.

Sixth argument. The important thing is that all citizens have jobs, that gives dignity, the others are palliative. Lagos: Of course, the fact that everyone has a job and a living worthy of him is great, but that does not happen, so could it be an OE solution to that situation? It dignifies the person... that life is guaranteed. Seven, with a guaranteed minimum life, the OE can move the workers’ struggle and make it easier for employers to do what they want. Lagos: In fact, fear is what discourages the struggle and fear has been heightened following the crisis and the 2007 pandemic. Further away from total employment, the situation of the workforce is becoming weaker. With the OE these weaknesses and fears are almost completely eliminated.

"For many unions, with the OE the worker can gain strength because he is in a better position to choose work, but that same reinforces individual positions and weakens the collective, the unions can lose collective strength"

French sociologist Robert Castel was a passionate advocate of this work/rights mindset: "Social history shows us how the autonomy of individuals was built on individual rights and, first of all, on labor rights." It considers that today, at the heart of the social problem, there is a deterioration in labour relations and working conditions that must be tackled and not covered: "The promoters of this minimum income consider that they are defenders of the person's autonomy, but I believe that this income will be the main instrument of institutionalization of dependency. Their beneficiaries would live desperate waiting for their use."

These statements were made in an interview 2013 by the Mouvement Journal, answering the questions asked by two sociologists in favor of the OE. Translated into Spanish by the journal Viento Sur, the dialogue summarizes some of the main positions against the OE in the vision of the left. Castel finished: "Some rights should protect all citizens. For example, right to health, retirement, housing, lifelong learning... In other words, between five and six of these basic rights form the basis of a person's social independence. I believe that more than 1,000 euros, there is the question, in that set of rights, which are controversial through the real struggles in the world of work".

Here is the proposal of the left-wing Spanish economist Eduardo Garzón. It considers that the OE would generate inflationary tension in the economy and would not be fair when the standard of living between the territories is different, with the same money, because in many regions less goods and services would be obtained. That is why the solution would be for citizens to benefit more than money, guaranteeing housing, basic energy, transport, custody, clothing or food. Perhaps not everything should be provided in services and a small part, for example EUR 200, could be for the purchase of food and clothing. Formulations can be several, always giving greater importance to what needs to be received in services. In short, the subsidised NC is the same as the current economic system; the RB strengthens the functioning of this monetarized system and leaves its beneficiaries in the ruin of the market, unlike the benefits in services.

Belgian philosopher and economist Philippe Van Parijs has been one of the main drivers of modern OE since the 1980s. So he called his article on the OE, perhaps as provocation, a capitalist path towards Communism. Today, the OE movement is clear that this right is not going to overcome capitalism, it is not going to be an instrument for it, but it can lead us to overcome welfare capitalism. In essence, they say that the NC is a land of rights, as a complement to other rights that we currently have – health, housing, pensions – but which are being dismantled. And they stress that we should talk about ceilings beyond the ground to limit the ceilings of wealth, because large accumulations of wealth threaten the foundations of democracy and freedoms. It should be remembered that tax policies against wealth in Europe or the United States, after the Second World War, with rates above 80% for richer incomes, sought that, weakening the influence capacity of the rich in states.

Four decades ago it was a proposal of basic income without dreaming and utopian conditions. Sadly, among the difficulties, he has travelled the way to this day, now his head appears towards the territory of emancipation and losing the next in the wave. As the reader has seen, it collects all kinds of opinions for and against, and, by surprise and by the crises, it is gradually moving. The truth, still as a pilot experience, but with many teachings. Some of them have already been mentioned in this Larrun, but in the short term dozens of other sessions will be held around the world.

It cannot be denied, it still lacks much to be credible in society, the citizen knows little about it, but with these pilots the dream is already getting slimmer and the reality getting stronger. We conclude the report with the words that university professor Gorka Moreno Márquez used to close the chapter on basic income in his book: "Universal suffrage was not a crazy thing either... Who could think that 200 years ago holiday or retirement would be economically protected? Who would think that health or education would be universal free social rights? And in the near future, why not universal basic income? ".

(Attached to this article is the one published in Larrun275: Global Income Pilot Experiences)

What happens when you're separated from life, environment or people and socially isolated for 3, 6, 10, 20 or 25 years? Who's in jail? What do we know about the men and women serving in Zaballa's macro-prison?

For those who have been serving prisoners serving sentences in Zaballa... [+]

We are in a process of Popular Legislative Initiative to create an unconditional Basic Income, and we are often debating the appropriateness or otherwise of the proposal. Not so much because of its proven economic viability, but because of more philosophical issues or how to... [+]