We have to stop our car factory for COVID-19 and drought in Taiwan

- At the end of January, the management of the company Mercedes in Vitoria-Gasteiz met with workers’ representatives to warn that the factory’s production chain was to be interrupted by the impossibility of acquiring certain electronic parts for cars, namely electronic chips. Two months later, on 27 March, it was forced to stop production. In a similar situation Volkswagen, Ford, Nissan, Toyota, Honda and most others have been found all over the world.

The airbags, the wipers, the electronic management of the motor, the interior computer that carries any car today, the parking sensors, the window elevators… all carry microchips, often more than 100. As cheap as the sophisticated ones, but you have to bring it from the other end of the world.

These electronic semiconductors, prefost, are increasingly present in the cavities of all artifacts made up of new technologies, and in 2020 there were signs of their shortage:Apple had to launch its latest iPhone on time, unable to meet all those waiting for the new Xbox and PlayStation consoles… Among them, chip suppliers like Samsung and Qualcomm were ahead of the commissions. By the end of the year the ‘txip idortea’ spread to the automotive industry and the press began to talk about the danger of an ‘Armagedon chip’.

The BBC Tech Theme Editor, Leo Kelion, has written that “the COVID-19 pandemic, as in many other issues that today are wrong in the world, is partly to blame.” The coronavirus closure significantly increased the sale of electronic devices for both work and leisure, but with the other hand the start of the pandemic sank sales of new cars and the automobile industry eliminated demands for electronic chips along with all other components.

However, by the end of 2020 the demand for cars was reheated more quickly than expected and when the industry reordered the piece, the manufacturing chains of the main manufacturers of microchips were focused on other products: computer, television, ‘smartphone’… And, as if that were not enough, with the speed that 5G infrastructures have taken, the demand had also increased. At the top of this, some experts believe that until the summer of at least 2021 the shortage of chips will not be overcome.

The production of these cheap electronic parts, which have become common in everyday equipment, also has geopolitical implications, as many of them have been aware of this. Taiwan and South Korea are the main producers of 83% of processor chips and 70% of memory chips. Taiwan and South Korea, monopoly chip producers, are today the leading TSMC Taiwan Semiconductor Manufacturing Company.

Another 22% of the market is in the hands of the US and 8% is in Europe. Europe has easily relinquished the production of semiconductors, because of its low cost of performance for the manufacturer, and it has now been seen that there is one of the major weaknesses of European industry, which is currently very important for the car, but also an entire economy that seeks to be a pioneer in digitalisation.

On the other hand, Taiwan’s leadership in producing this key component of the economy only increases China’s desire to closely control the island. Taiwan plays the heart of Chinese nationalism halfway, but in its economy the island is particularly important with its microchips. International experts forecast in Taiwan the next violent clash between the United States and China.

Thus, the shocks and changes caused by COVID-19, including the leap in the digitalisation of the economy, would be sufficient to explain the microchip crisis. But there has also been another factor: The great drought that Taiwan has experienced in recent years. What does it have to see the lack of water with microchips of dry silicon?

Where have the typhoons gone?

Kurt Cobb is a journalist specializing in energy and raw materials that wrote in the blog Resource Insights: “Few thought Taiwan could one day lack water for its industry.” The island of Taiwan, in the Pacific, is located in the Tropics of Cancer and receives 2,500 liters of water a year, many of them brought so far by typhoons traveling three times a year. But by 2020, they haven't got a single typhoon. One scientist explains that the high pressures between the Pacific and Southeast Asia have formed a barrier around Taiwan, diverting typhoons to Japan and South Korea. They expect half of the typhoons available so far to arrive by the end of the century.

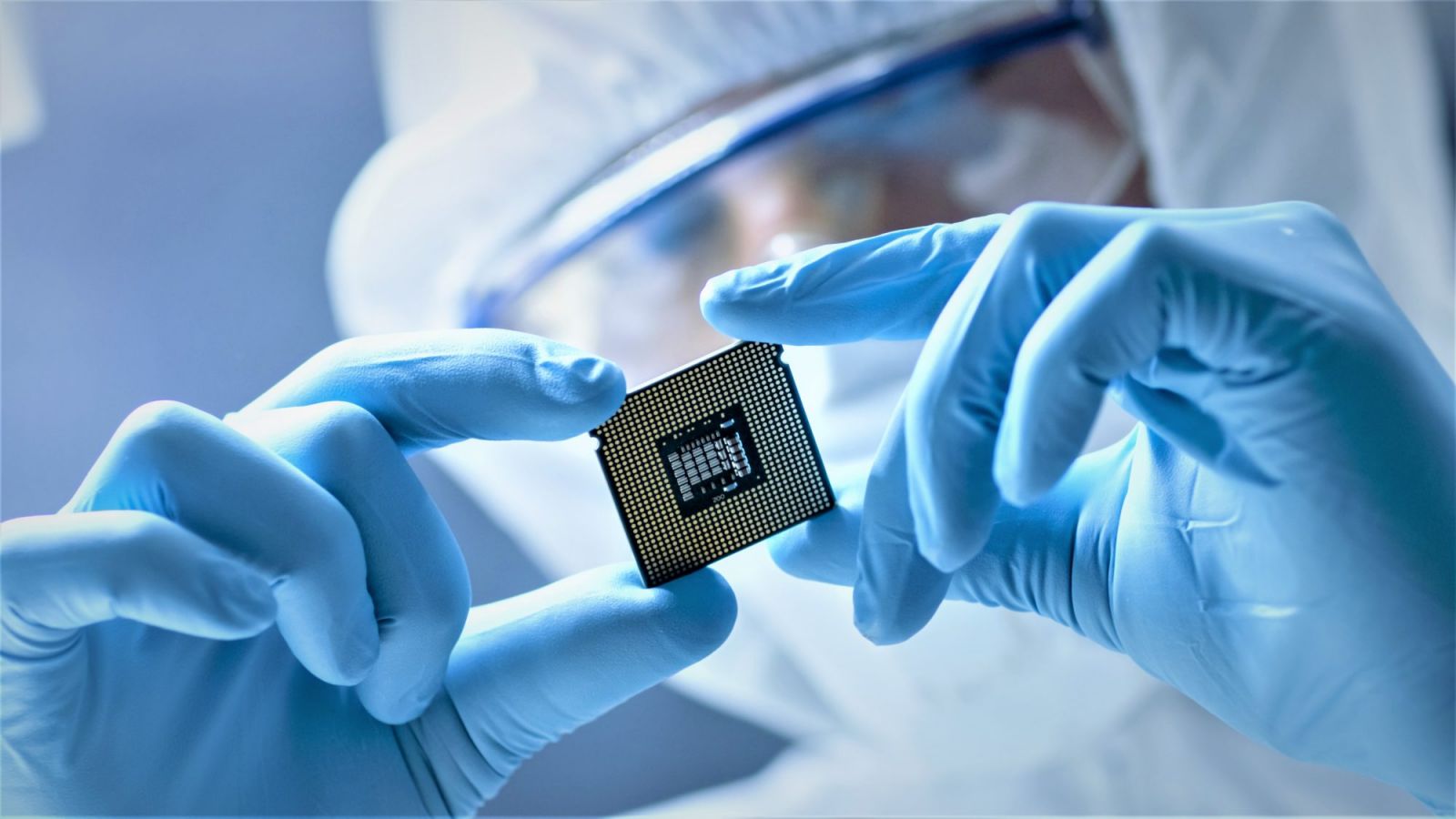

This current drought has hit the farmers of Taiwan, many of whom cannot irrigate fields and orchards. But the electronics semiconductor industry is also running out of enough water. According to the Chinese organization China Water Risk, water supply is critical to this industry. Semiconductors are built on silicon wafers, in layers, washed at all times with ultrapure water, UPW. To have 1,000 liters of this UPW, which must be thousands of times purer than tap water, you need between 400 and 1,600 liters of tap water.

Running a typical 30 cm Silicon wafer composed of circuits requires 6-600 UPW of water. Therefore, a 40,000 wafer factory a month can spend on one day all the water a village of 60,000 inhabitants needs in one year.

By the way, the microchip industry is as energy-intensive as it is in water. In China Water Risk calculations, a single factory can swallow between 30 and 50 Megawatts of electricity enough to satisfy a small city.

It is true that this industry has also improved in water management for needs, reusing the same water, etc. But Kurt Cobbe commented that the Bloomberg agency, which has hardly any ecologist, has given the data that in the global semiconductor Taiwan Semiconductor Manufacturing Company consumes in one day 156,000 tons of water, 10% of the region's total water that has the main aroma.

Taiwan has been able to produce chips at prices and quality without competition and has been outsourced to Taiwanese by leading global companies in new technologies and electronics. Now, however, the headaches that automotive uses in the West have shown the weakness of the global chain accustomed to working ‘just-in-time’.The system works, yes... until it stops.

“Taiwan’s aridity – says Kurt Cobbek – shows what can happen when several risks come together: climate change, concentration of vital industry in a graphic space, subcontracting, international tensions and weak supply chains.”

2021etik 2025era isuriak %15ean murriztu behar zituen industriak. Ursula Von Der Leyenek automobilgintzaren sektorearen eskutik ekintza plan bat aurkeztuko du martxoaren 5ean. Oraindik erabakia hartua ez badago ere, Europar Batasunak sektorearen eskaerak onartuko dituela diote... [+]

The devastating characteristics of today ' s global world, wars, ecological and social injustices herald an apocalyptic representation of the future anywhere on the planet. Echoes of the nuclear threat further dispel the concern of fear and concern, while politicians... [+]

The effective tax rate that Amazon paid in the last decade was 13 percent. By 2020, the 55 largest companies in the United States did not pay taxes. The effective rate on the profit of companies that in the Spanish state invoiced more than one billion euros was 4.57% in 2019... [+]