The global economic crisis is about to revive

- We are increasingly hearing that the global economic context is marking a new crisis. In the press, the media and the Internet a number of news stories have been launched in this regard. But where should we pay attention to know what is coming? We've brought here some red lights announcing a storm.

We do not say that, even in the most prestigious international newspapers, they are alarming to warn that a global setback is coming. On the same day that the G7 summit was held in Biarritz, Phillip Inman, one of the major economic analysts of the British newspaper The Guardian, told us seven indications in an article that we will summarize here. In his view, the "engine" of world trade is warning us that it has taken the reverse path after ten years of "expansion".

End of U.S. interest rate cycle

One of the main symptoms is the increase in tariffs between the United States and China, which have already changed. Donald Trump started his presidential campaign saying “First United States!” and applied tariffs of 25% to steel imports, including the Basque Country. Above all, Trump focuses on China, which accuses it of taking advantage of a cheaper currency and which has raised import taxes on certain Chinese products. The answer from Beijing has been to devalue Yuana further. It is difficult to measure the consequences of this war, but most countries have already noticed a decline in trade.

On the other hand, Trump’s tax reduction policy has raised inflation in the United States. United States and has caused the central bank of that country – the federal reserves – to have raised interest rates several times in recent times.

.jpg)

This increase in indebtedness and the tariff war with China have ultimately affected industrial production in the United States and consumer prices. On August 1, 2019, Federal Reserve President Jerome Powell announced a fall in interest rates for the first time since 2008, when September 18 dropped by 0.25%. Other information: The 48,000 workers at General Motors went on strike to call for a dignified agreement – the last unemployment occurred twelve years ago – and the car company began a remodeling in 2018 affecting some 15,000 workers.

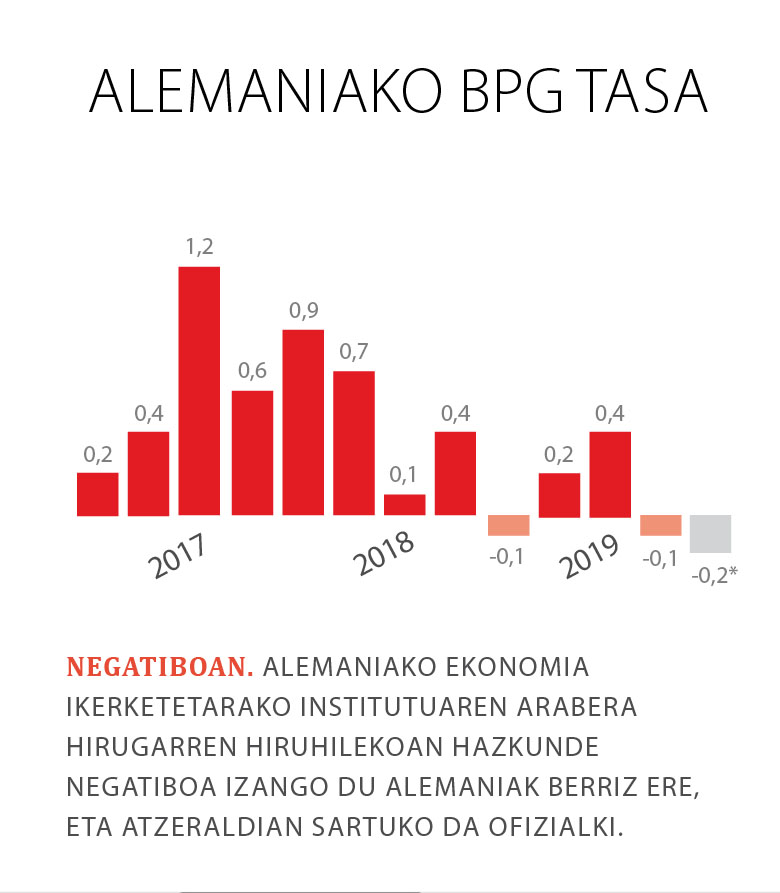

Germany in technical recession

“The German economy will probably remain lifeless in the third quarter of 2019. GDP can continue to fall.” This phrase, which can be read in the last report by the Bundesbank, fell like a bomb in August. German Gross Domestic Product fell by 0.1% in the previous quarter and, if it collapsed for the second time in a row, the European locomotive would officially enter a "technical recession". Finance Minister Olaf Scholz has announced an investment of EUR 50 billion as an incentive, but many economists believe it is too late to avoid recession.

Germany exports industrial products – see Analysis of the Bakaica Ballenera on page 19 – and among other reasons, the nervousness caused by Brexit has been one of the reasons for the recession. If the United Kingdom leaves the European Union without agreement, it could harm trade, according to most analysts, which is the sixth economy in the world. Boris Johnson’s particular struggle against the parliamentary majority has not served to relax the atmosphere, either to hold a hard Brexit on 31 October or to advance the early elections.

Nick Dearden, director of the alterglobalist organization  Global Justice Now, has seen the black clouds in a letter written in the magazine of the left Red Pepper: “From the moment Johnson has become prime minister, we’re clearer how the extreme Brexit is going to be: A toxic trade agreement with the United States, an environment against millions of migrants and free market policies, spreading to more and more areas of society.” In his opinion, another example of the shock doctrine theorized by Naomi Klein is that neoliberalism will once again take advantage of the psychological impact generated by a “catastrophe” to carry out antisocial reforms.

Global Justice Now, has seen the black clouds in a letter written in the magazine of the left Red Pepper: “From the moment Johnson has become prime minister, we’re clearer how the extreme Brexit is going to be: A toxic trade agreement with the United States, an environment against millions of migrants and free market policies, spreading to more and more areas of society.” In his opinion, another example of the shock doctrine theorized by Naomi Klein is that neoliberalism will once again take advantage of the psychological impact generated by a “catastrophe” to carry out antisocial reforms.

So things, don't look at late or default in Argentina, but at the economic situation in South Africa and Turkey, according to Guardian Inman's journalist. These countries are much more “integrated” in international markets and debt default would have a greater impact.

The Turkish lira is weak and GDP is not enough to contract. Financial speculators are constantly looking at these kinds of symptoms. Thus, investors have recently sold numerous short-term debt securities in the United States – the same they did before the 2008 crisis. This behavior has drawn a dangerous line that shows that the U.S. economy can get into trouble before it's too late: the reverse yield curve.

The yield curve is:

“Performance Curve”. As we learned in 2008 what the risk premium was, on this occasion we will also need to know what this concept is to understand the origin of the next economic crisis. “Performance Curve”. What is it? Economist Alberto Garzón explained it on Twitter in the most didactic way possible, and Gorka Bereziartua has brought these explanations to the ARGIA website.

The graph of the yield curve shows how long and short-term interest rates for securities are. When a State issues securities at auction, the interest rate it has to pay for receiving that money varies depending on the number of purchasers, i.e. the “yield”. More shoppers, less performance. And vice versa: fewer shoppers, more performance. In the case of long-term securities, such as bonds to be returned to three or four years, there are often fewer buyers, because they have to wait longer to collect interest. Consequently, the performance curve is usually positive, with the appearance of a hill.

On the contrary, when a difficult economic situation is announced, investors prefer to access more secure long-term securities from the richer countries and the curve is reversed into a precipice. At the moment, the curve is in twenty countries upside down, and also in the United States. Garzón recalled that “every time the American curve has been reversed since 1955, there has been an economic setback. Sometimes months later, sometimes a year.” According to the economist, if this continues, the United States will enter into economic crisis in the short term.

Over .jpg) the past ten years, central banks have donated free money to financial institutions, and many believe that the source of the performance curve atrophy lies in the bubble generated. In Garzón’s view, it is pointless for governments to inject more money – as Minister Scholz has proposed for Germany – and taxation is the key. However, he has admitted that there are already left-wing economists who do not believe in fiscal policy, as is the case with Michael Roberts.

the past ten years, central banks have donated free money to financial institutions, and many believe that the source of the performance curve atrophy lies in the bubble generated. In Garzón’s view, it is pointless for governments to inject more money – as Minister Scholz has proposed for Germany – and taxation is the key. However, he has admitted that there are already left-wing economists who do not believe in fiscal policy, as is the case with Michael Roberts.

Michael Roberts: “It won’t work”

“Neither the easing of the currency nor the tax incentives will stop the next recession.” That's what the economist Michael Roberts has brought out, and the old Marxist already knows what it's all about, because to write on the blog The Next Recession takes advantage of the experience that he's been working on for 30 years in the City of London.

Roberts has highlighted several indicators that can lead to red alarms in the city of Maryland. On the one hand, we have just learned that the US Manufacturing Activity Index (PMI) data has been bad. This index is obtained through a monthly survey of significant companies to learn about the evolution of the productive economy: If it's over 50 points it means it's expanding, it would contract below it, and below 42 points it would be in recession. Well, for the first time since 2009, U.S. production has fallen below 50.

Roberts has also underlined another fact directly related to US companies: their profit margin is being reduced in more time than ever. The profits of corporations remain at a very high level, as they took advantage of the situation of the crisis of 2008 to achieve a greater overgrowth of workers, but in the last four and a half years the profit margins have been decreasing, and since the post-war period there has never been anything like this: “Although the performance curve can be looked at every day, it may not be the best indicator to see that the recession comes, but the decline in profits.” We can imagine again what they're going to put into the juices machine.

To turn the situation around, the economist considers that the Orthodox and Heterodox Keynesian formulas, including the Modern Monetary Theory in the mouthpiece, are going to be sterile (budget deficit, public spending, tax incentives…) and has set the example of Japan: it has been in a budget deficit for 20 years and has not achieved growth of more than 1%. Roberts has received many criticisms of these kinds of ideas, including from his leftist headmates, but in the end he has ended up talking hairless in his mouth: “Capitalism can emerge from a recession, only with recession.”

The world's debt, the highest ever

A decade after the Lehman Brothers disaster, writing about the consequences of the crisis in our country (No. 2,620). ), economist Mikel Zurbano recalled that the current global debt far exceeds that of 2007 and that GDP is already four times higher: “You can repeat the explosion ten years ago.”

Debt is an issue that is constantly linked to the crisis: “Is the world going bankrupt?”, “The global debt powder keg,” “Debt has ignited all the alarms,” the media headlines repeat over and over again. The International Monetary Fund has also launched on numerous occasions, the last in December 2018, saying that we have broken the “record”: 161 billion euros. But we cannot forget that debt is a powerful weapon used by international financial institutions.

Eric Toussant, Doctor of Political Science and spokesperson for the Commission on the Abolition of Illegitimate Debts (CADTM), believes that debt is "something similar to a new colonization". In response to Arantxa Manterola's questions from Gara newspaper, Berasaluze explained that the Biarritz player was on the G7 counterclockwork. “The lenders have managed to introduce the states into the gear of public debt, which allows them to get huge profits (…) Since the time of Thatcher and Reagan the states are obliged to pay more debt, renouncing their obligations to the citizens.”

In 2008, central banks widened the crisis by separating money as if it were an orphidal to bankrupt financial institutions and opening the door wide to speculative products.

Now he's about to wake up again, and we can imagine what they put in the juices machine.

It is clear that if the crisis broke out, people in the most indebted countries would see the clashes, as states would be less likely to get resources. For Toussant it is possible to cancel an illegitimate debt, history has demonstrated both in Mexico in 1919 and in Iceland a century later, but to do so “we must rebel the citizenship and put pressure on governments.”

The 2008 crisis was exacerbated by the central banks, which distributed the money as if it were orphidal to bankrupt financial institutions, opening the door to speculative products. It points to another word for the economic notebook: QE (Quantitative Easing) In so doing, central banks massively acquire financial assets, saving those engaged in large speculative business. On the contrary, Labour Jeremy Corbin long ago proclaimed “a QE of the people” that will finance, among other things, social services.

But the President of the European Central Bank (ECB), Mario Dragui, has said that it will bring from -0.4% to -0.5% the interest rate that banks pay for leaving their money in deposit, which will charge more, and that it will buy EUR 20 billion of public debt per month in bonds. Money, money, money. The crisis is about to wake up, and when you put it in front of the mirror, you see again the true face of capitalism.

.jpg) 1944ko uztailaren 22an, duela 75 urte, Bretton Woodseko akordioa sinatu zuten Bigarren Mundu Gerra irabaztear ziren herrialde aliatuek. AEBetako New Hampshireko hotel hartan, Nazio Batuen Erakundeak munduko finantza harremanak ezarri zituen eta halaxe sortu ziren Nazioarteko Diru Funtsa (NDF) eta Munduko Bankua, dolarra erreferentzia gisa hartuta. AEBetako boterea eta eragina nabarmenak izan ziren sorrera hartan eta erakunde horien bilakaera baldintzatu zuen horrek.

1944ko uztailaren 22an, duela 75 urte, Bretton Woodseko akordioa sinatu zuten Bigarren Mundu Gerra irabaztear ziren herrialde aliatuek. AEBetako New Hampshireko hotel hartan, Nazio Batuen Erakundeak munduko finantza harremanak ezarri zituen eta halaxe sortu ziren Nazioarteko Diru Funtsa (NDF) eta Munduko Bankua, dolarra erreferentzia gisa hartuta. AEBetako boterea eta eragina nabarmenak izan ziren sorrera hartan eta erakunde horien bilakaera baldintzatu zuen horrek.

NDFren helburu nagusietakoa da zailtasun ekonomikoan dauden herrialdeei dirua uztea hainbat baldintzaren truke. Bere jokabidea oso kritikatua izan da, inposatzen dituen murrizketa planak oso gogorrak direlako eta gastu sozialari bete-betean eragiten diolako. Behar gorrian dauden herrialdeak menpekoago egiteko, zorra erabiltzen du batez ere, eta politika neoliberalak ezartzeko berdin zaio diktadurak laguntzen baditu ere.

Eric Toussaintek (CADTM) “kolonialismo berria” deitzen dio horri. Bere liburuetan azpimarratu izan duenez, bai NDF-k bai Munduko Bankuak diktadurei emandako laguntza sistematikoa izan da, haien politiketan zuzenean eragiteko asmoz: Somoza Nikaraguan, Pinochet Txilen, Mobutu Zairen… Paradoxikoki, Munduko Bankuko estatutuek espresuki debekatzen diote arlo politikoan esku hartzea: “Irizpide ekonomikoek baizik ezin dute bere erabakietan eragin”.

Baina giza eskubideak urratzen dituzten erregimen politikoekin soilik ez, ekonomiaren gorabeherekin ere jolastu izan dute bi erakundeok, informazio nahasgarria nahita emanez. Hala egin zuen Mundu Bankuak 1982an Hego Ameriketan leherturiko krisiarekin. 60ko hamarkadan banku horrek askotan jaurti zituen zenbait herrialdetako zorpetze handiagatik egon zitezkeen arazoen inguruko abisuak. Baina Toussaintek dioenez, 1973ko petrolioaren prezioaren gorakadaren ondoren diskurtso bikoitza hasi zuen: alde batetik, publikoki “krisi” hitza erabiltzeari utzi eta are gehiago zorpetzera bultzatu zituen herrialdeok. Bestetik, barne memorandumetan aitortzen zuen asko “muturreko egoerara” irits zitezkeela maileguak ezin kitaturik. Alegia, bazekien krisia bazetorrela.

Nola azaldu Munduko Bankuaren jarrera hori? Petrolio esportatzaileek dirua barra-barra zuten 1973ko prezioen gorakadaren ondorioz eta beste herrialdeetako zorrean inbertitzen hasi ziren. Baina Toussanten ustez badago beste arrazoi bat: “Munduko Bankuak bere eragina handitu nahi izan zuen kapitalismoaren aldean zeuden ahalik eta herrialde gehienetan”. Hortaz, 1978 eta 1981 urteen artean mailegaturiko dirua %100 handitu zen, 1982an krisia lehertu zen arte. Hala hasi zen Hego Ameriketako “hamarkada galdua” deitu izan dena, Mundu Bankuak eta NDF-k gidatuta.

Badago krisi hura 2008ko Atzeraldi Handiarekin alderatzen duenik. Duela hamarkada bat, NDF desprestigiaturiko dinosauro bat zen, baina finantzen paperezko gaztelua erori zenean, herrialde boteretsuenek funts horren kata-narrua berriz gizentzea erabaki zuten, jarrai zezan beti egin duena egiten: xantaia ekonomikoaren bidez herritarrak estutu. Zer gertatuko da oraingoan? Ez dirudi NDFk dominaziorako abagune berri hau alferrik pasatzen utziko duenik, hala iraun baitu 75 urtez.

Pazienteek Donostiara joan behar dute arreta jasotzeko. Osasun Bidasoa plataforma herritarrak salatu du itxierak “are gehiago hondatuko” duela eskualdeko osasun publikoa.

PPrekin eta EH Bildurekin negoziazioetan porrot egin ondoren etorri da Ahal Dugurekin adostutako akordioa. Indar politiko honek aitortu duenez, maximalismoak atzean utzi eta errealitateari heldu diote, errenta baxueneko herritarren aldeko akordioa lortuta.

.jpg)