Strengthening the cooperative banking model

- Caja Laboral and Ipar Kutxa have formed the Basque Credit Cooperative. The journey will begin on 1 January and over the next year it will be stabilising. The new cooperative will be the second financial institution in the Basque Country and the second credit cooperative in the Spanish State.

It has been eight months since Caja Laboral and Ipar Kutxa started talks about setting up a joint credit cooperative. On 20 March 2012, both entities officially announced the start of the formal negotiations of the entity. Since then, the representatives of both entities have worked in various areas with the aim of reaching agreements for the implementation of this new and pioneering Basque credit cooperative. It was announced on 1 November that it was a single legal entity. Starting on 1 January 2013, operational pooling will begin and end.

In this period we have seen multiple media advertising announcing a new banking model, a new way of working with customers, a desire to become active agents to promote economic recovery… Now is the time to put all that into practice. And the project leaders are in full activity. The new market brand will be a combination of the brands of Caja Laboral and Ipar Kutxa, which will capitalize on the value and positioning of both entities.

At this new stage, however, events have emerged which, unfortunately for the MCC group, its companies Fagor and Eroski and Caja Laboral, may prove harmful. The financial contributions of Eroski and Fagor, as well as the preferred shares of a number of financial institutions, have caused damage to many customers claiming the repayment of the money saved, after legislation not foreseen in 2004 has mortgaged their savings. This could weaken the image and credibility of the MCC Group, if the Mondragon Group does not resolve the issue transparently.

Second financial institution in the Basque Country

With the integration of Caja Laboral and Ipar Kutxa into a single credit cooperative, the resulting new entity will become the second financial institution in the Basque Country and the second credit cooperative in the Spanish State, strengthening its market position, especially in Bizkaia and Álava. In this way, the new cooperative will manage a total of assets above EUR 25 billion. In addition, in Hego Euskal Herria there are more than 860.000 clients (750,000 in the CAV and 110,000 in Navarra), and if we add to that the clients of Caja Laboral in other communities, the new entity will have more than 1,300,000 clients.

Both entities comprise 451 offices (364 Caja Laboral and 87 Ipar Kutxa), with a total of 2,497 employees (2,100 Caja Laboral and 397 Ipar Kutxa). Following the establishment of a single credit cooperative, several offices and jobs will be reduced, although there does not appear to be major changes in this area.

Unity, strength. The business plan for integration has been carried out with caution and forecasts have been drawn up on the basis of a negative banking context. The new cooperative will therefore fulfil all the solvency requirements. In fact, in this exercise, in addition to covering all the endowments and expanding the portfolio of companies and individuals, it

has achieved a prominent fund for coverage general.En the opinion of its managers, this alliance will improve its strategic position as a local entity and boost a financial entity based on the social economy, with the objective of providing financial services and assurance to the markets in which the organization integrates. The current model is the result of the transformation of the financial system into a bank, and the new entity also wants to offer an alternative to this model. In the words of those responsible, the proposed new model seeks to maintain closeness with clients, and its objective is to play a relevant role in the new financial situation, in order to promote economic and social development from a new perspective. In addition, the new cooperative project will continue to work with industry and the agri-food sector by leveraging the knowledge of the two supporting entities.

Its registered office in Arrasate

The new Basque credit cooperative will have its head office in Arrasate. To date, Ipar Kutxa was based in Plaza del Arenal in Bilbao, and will now host the operational sub-offices of the Commercial Network of the Retail Bank and its Business Committee, as well as the Territorial Directorate and the corresponding support structures. In addition, the headquarters of the Lagun Aro Insurance, the Holding Company and the Insurance Managers will be maintained in the Vizcaina capital.

The Governing Council shall consist of a total of 15 members: 12 Caja Laboral y 3 de Ipar Kutxa. The assemblies of the two merged entities have appointed Txomin García as president of the new entity, until now as general director of Caja Laboral.

“Bi pertsona mota daude munduan: euskaldunak, batetik, eta euskaldunak izan nahiko luketenak, bestetik”. Gaztea zela, Mary Kim Laragan-Urangak maiz entzuten omen zuen horrelako zerbait, Idahon (AEBak), hain zuzen. Ameriketan jaio, hazi, hezi eta bizi izandakoak 70... [+]

Martxoaren 8a, Emakumeen Nazioarteko Eguna, munduan zehar milioika emakumeontzat berdintasuna, eskubideak eta justizia eskatzeko borroka eguna da. Hala ere, gerrek, gatazkek eta politika militaristen hazkundeak markatutako testuinguru global batean, inoiz baino premiazkoagoa da... [+]

Geroa Baiko lehendakari eta Nafarroako lehendakariorde izandakoa enpresa bati 2,6 milioi euroko diru-laguntzak ustez modu irregularrean emateagatik zegoen auzipetuta, Davalor auzia deiturikoan. Nafarroako Probintzia Auzitegiak erabaki du auzia behin betiko artxibatzea, legalki... [+]

Nahiz eta Nazio Batuen Erakundeak (NBE) 1977an nazioarteko egun bat bezala deklaratu zuen eta haren jatorriaren hipotesi ezberdinak diren, Martxoaren 8aren iturria berez emazte langileen mugimenduari lotua da.

Euskal Herriko Bilgune Feministak deituta elkarretaratzea egin dute Hernanin Iratxe Sorzabali elkartasuna adierazi eta "babes osoa" emateko. Inkomunikatuta egon zen uneak berriz ere epailearen aurrean kontatu behar izatea, "bizi izandakoak utzitako ondorioen... [+]

Lantzeko inauteri txikien kalejira ikusle guztien begietara urtero modukoa izan zen. Txatxoak, Zaldiko, Ziripot eta Miel Otxin herriko ostatuko ganbaratik jaitsi eta herritik barna bira egin zuten txistularien laguntzarekin. Askok, ordea, ez zekiten une historiko bat bizitzen... [+]

Errekaldeko Gaztetxearen aurkako huste-agindua heldu da jadanik. Espazioa defendatzera deitu dute bertako kideek.

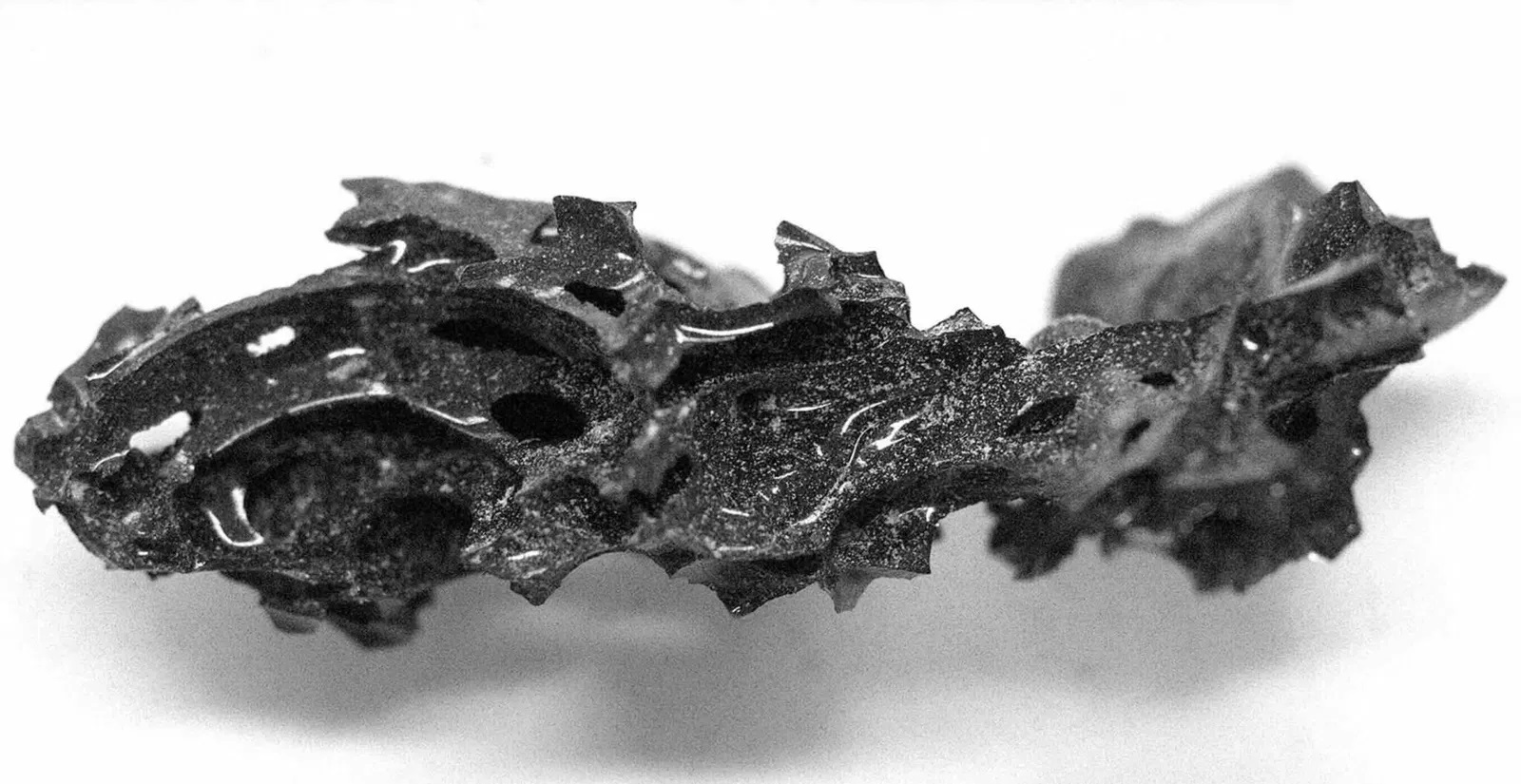

79. urtean, Vesubio sumendiaren erupzioak errautsez eta arrokaz estali zituen Ponpeia eta Herkulano hiriak eta hango biztanleak. Aurkikuntza arkeologiko ugari egin dira hondakinetan; tartean, 2018an, gorpuzki batzuk aztertu zituzten berriro, eta ikusi zuten gizon baten garuna... [+]

Leporaturikoa ez onarturik, eta sare sozialetako kontuak "lapurtu" zizkiotela erranik, salaketa jarri zuen Arabako campuseko Farmazia Fakultateko irakasleak. Gernikako auzitegiak ondorioztatu du ez dagoela modurik frogatzeko mezu horiek berak idatzitakoak diren ala ez.

Lan baldintzen "prekarietatea" salatzeko kontzentrazioa egin zuten asteartean egunkariaren egoitzaren aurrean. Abenduaren 2tik sindaura greban daude langileak eta mobizlizazioak "areagotzea" erabaki dute orain.

Martxoaren 6an 11:00etan Bilbon eta Iruñean mobilizazioak egingo dituzte sindikatuek, patronalak eta Eusko Jaurlaritza zein Nafarroako Gobernua interpelatzeko, zaintza eskubide kolektiboari dagokionez.

Luxorren, Erregeen Haranetik gertu, hilobi garrantzitsu baten sarrera eta pasabide nagusia aurkitu zituzten 2022an. Orain, alabastrozko objektu batean Tutmosis II.aren kartutxoa topatu dute (irudian). Horrek esan nahi du hilobi hori XVIII. dinastiako faraoiarena... [+]

AEB, 1900eko azaroaren 6a. William McKinley (1843-1901) bigarrenez aukeratu zuten AEBetako presidente. Berriki, Donald Trump ere bigarrenez presidente aukeratu ondoren, McKinleyrekiko miresmen garbia agertu du.

Horregatik, AEBetako mendirik altuenari ofizialki berriro... [+]

Andeetako Altiplanoan, qocha deituriko aintzirak sortzen hasi dira inken antzinako teknikak erabilita, aldaketa klimatikoari eta sikateei aurre egiteko. Ura “erein eta uztatzea” esaten diote: ura lurrean infiltratzen da eta horrek bizia ekartzen dio inguruari. Peruko... [+]