Tobin is not Booty

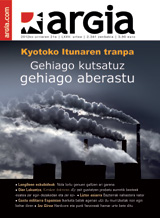

New tobin tax in newspapers. They want us to believe that governments are going to implement the Tobin Tax or Financial Transaction Tax (TTM) and use it to alleviate the crisis. This tax has long been talked about at international summits, but its application is always delayed. However, it should be noted that James Tobin, the Nobel Peace Prize in 1971 and promoter of the tax, is not Emilio botín nor Francisco González, president of the Banco Santander and BBVA, respectively. Tobin wanted to carry the flow of capital to slow down the process, speculate less and prevent the exchange measures from having so much fluctuation. The tax now proposed seeks to tax raw transactions, before any compensation, and focuses its attention on financial transactions. The proposed tax measures are 0.1% for shares and bonds and 0.01% for derivatives. The European Union, on the other hand, has set aside the most just and social option: Financial Activities Rate (FAT). The purpose of this tax is to tax the added value of the financial sector – an amount obtained by increasing profits and wages, including bonds to bank directors and fund managers.

Fear is spreading because it can go unnoticed that the tax burden affects customers, albeit indirectly, through commissions, for example. Who controls that? The influential MEP Sharo Bowles said that the FTT, as voted, looks more like the Nottingham sheriff than Robin Hood. It is certain that it will meet more, but to pretend that banks and speculators are going to bear that cost, is to deceive. Botín and González are not Tobin. It is obvious.

PPrekin eta EH Bildurekin negoziazioetan porrot egin ondoren etorri da Ahal Dugurekin adostutako akordioa. Indar politiko honek aitortu duenez, maximalismoak atzean utzi eta errealitateari heldu diote, errenta baxueneko herritarren aldeko akordioa lortuta.

The Araba, Bizkaia and Gipuzkoa Foral Haciendas have just extracted the data from the collection, and we have seen that they have received more money than ever before. They soon announce that they will take the necessary margin for reflection on tax reform, because there is no... [+]

The market owners, when asked to accept any kind of limitation or control, have said no – as we have seen in the case of rents and staple foods – as often as they have said no. They have faced the Government when it has sought to tax excesses in the light force business and... [+]