The European Central Bank: the key to the crisis in its hands

There is no one who understands this crisis, says the average citizen, who wants to respond to the subordination of politics to the economy. Well, some critical economists predicted the crisis in southern Europe, after the signing in Maastricht of the Economic and Monetary Union agreement in 1992, in one way or another.

The very design of economic union is the origin of the difficulties faced by the eurozone countries in providing effective political responses to economic shocks. With monetary union, countries do not have the monetary policy instrument, but the European Central Bank (ECB). In fact, the emblem of this liberal design was the European Central Bank, it was structured as an “autonomous” organization with political power and its profile repeated that of Bundesbank in Germany, with the sole objective of combating inflation.

Debt financing in the peripheral European states is known to be very serious. Any public debt financing state, such as the United Kingdom, which has a giant public debt, borrows from its central bank, which is cheap financing that runs out over the years (mainly due to inflation and income growth). In the Eurozone this cannot be done directly, but it can be done indirectly, and so has the ECB, which a year ago has the ability to issue money indefinitely, with the debt of Ireland and Portugal. Traders in these debt markets are trying to make the most of their profits in exchange for lending them. However, the increase in the financing of the Spanish public debt is not due to speculation, which is, at least in staggering size, the law of the markets. The cost of interest on the public debts of the Spanish State and the other States of the euro area is determined by the ECB, which is currently primarily responsible for over-financing the public debt of the peripheral countries. That is why it is sterile that, in the midst of crisis, we should endeavour to limit the level of public deficit over and over again. The continued push for austerity measures and cutbacks to lower the interest on public debt, the famous risk premium, has neither feet nor heads if a serious effort is to be made to leave the crisis behind.

The ECB is the hiding place of the powerful financial lobbys of Europe and, above all, of Germany, their ‘autonomous’ character, the composition of the management – with Draghi as a symbol – and the leadership of the EU economy are a reflection of this. The ECB does not buy public debt from the Spanish State and Italy because it wants to put pressure on its governments to take very controversial measures in society and to benefit the interests of its internal lobbies. Some authors intend to set in its entirety an agenda for the situation they have called the “liberal coup d’état”. That is why the ECB has granted loans to private financial institutions worth EUR 1 trillion – with an interest rate of 1% – without imposing conditions, while obliging states to comply with tough austerity measures to buy public debt. The extreme austerity advocated by Bundesbank has led to the destruction caused by financial and real estate bubbles to an unsolvable level: it has multiplied unemployment, the deficit and the financial problems generated by it in the peripheral countries of the euro zone in two years. Rescues from the Spanish State and Italy will aggravate the situation. A crisis that could have been easily managed at the outset is today a threat to the euro itself. The ECB holds the key in the short term, if we are able to understand it.

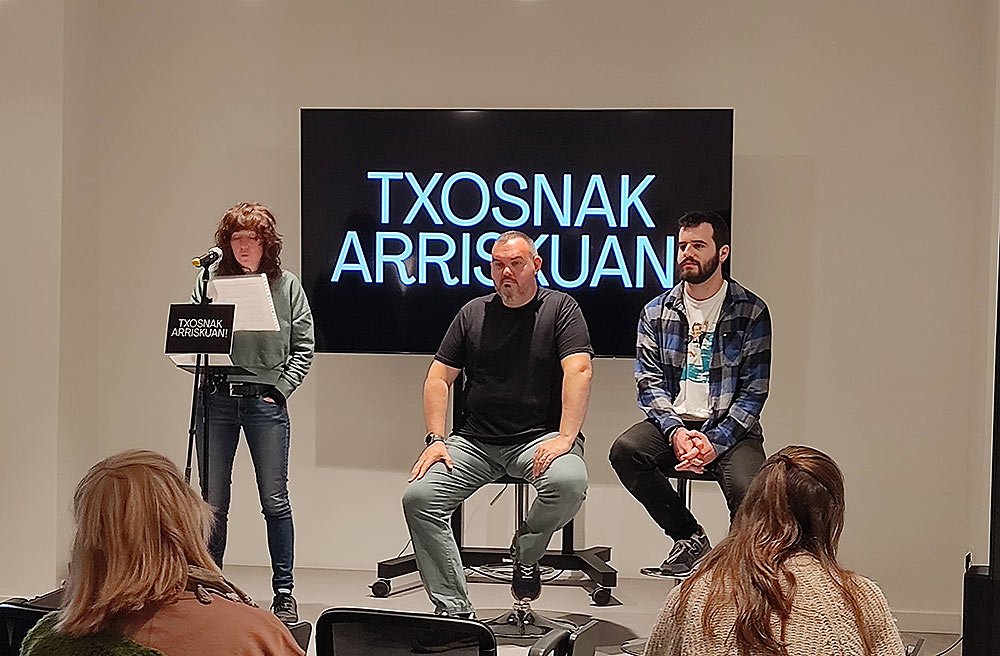

BRN + Neighborhood and Sain Mountain + Odei + Monsieur le crepe and Muxker

What: The harvest party.

When: May 2nd.

In which: In the Bilborock Room.

---------------------------------------------------------

The seeds sown need water, light and time to germinate. Nature has... [+]