"Cutting policies fail"

- It was during the years when Roberto Lavagna was Minister of Economy and took a turn to the Argentine economy. In order to deal with the crisis that began in 2001, it stopped paying the debt to credit providers and set in motion policies to increase production. Argentina managed to get out of the corralito and began a period of great growth. The economist has compared in this interview this experience with what Greece has experienced today all its life.

Roberto Lavagna (Buenos Aires, 1942) was Minister of Economy of Argentina during the term of President Eduardo Duhalde and the first government of Néstor Kirchner (2002-2005). Lavagna designed an economic recovery plan following the severe crisis suffered by Argentina. The then Argentina and the present Greece admit, in the opinion of the former minister, some similarities. The Argentine experience has left some lessons on policies based on social cuts.

Lavagna took office in April 2002. Months earlier, in December 2001, there were violent clashes between citizens and police. State forces ended the lives of 38 citizens in repression. President De la Rúa resigned and five presidents were appointed within two weeks. The lack of credibility of politicians was total after the outbreak of the crisis.

What was the economic situation in Argentina like when he took office as Minister of Economy?

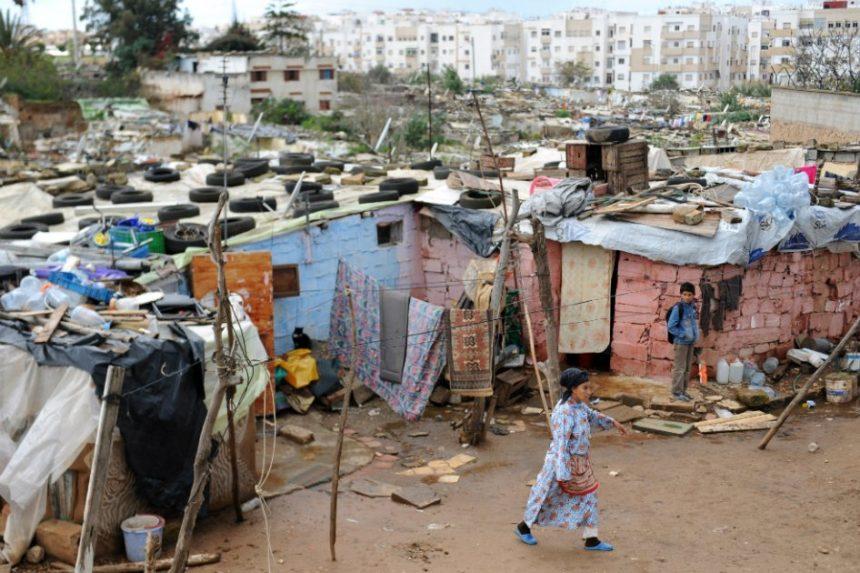

Argentina had a significant fiscal deficit, a current account deficit and was on a hyper-inflation path. The social situation was also very serious: between 52% and 54% of the Argentinians were in poverty, with 18% unemployed, without investment and, therefore, without the possibility of job creation in the short term. By then, the country's Gross Domestic Product (GDP) was contracted for the fourth consecutive year. Moreover, although the ruler [Eduardo Duhalde] was appointed in compliance with the Constitution, the issue was different with regard to the accession of citizens. We didn't have a majority in Congress. The governors of the Judicial Party (Peronist Party) gave Duhalde a 30-day ultimatum and asked him to complete a 14-point economic program a day before I took office.

Is the situation in Argentina comparable with that in Europe today?

I would refer specifically to Greece. Because the situation in Greece is not the same as that in Italy or Spain. In the case of Greece, economic data are very similar. It has a twin deficit (fiscal and current account), the economy contracts for the fourth consecutive year, the unemployment rate is high… There are many economic similarities, except inflation. Argentina was on the road to hyper-inflation and that is not happening in the case of Greece.

The greatest differences are in the social sphere. In Greece, the social situation is much better. Per capita income is much higher, as it is largely a member of the European Union. And as for the institutions, there are also differences. Argentina was completely isolated and Greece is part of one of the most powerful political and economic groups in the world. If there is political will, there are resources to deal with the problems. Another question is whether there is will. In view of the movement around Greece, at least, a debate has been opened. In the case of Argentina, there was none of that. The possibility of intervening in Argentina was considered at the most, as was the case with Austria following the First World War.

What is happening is that the case of Greece has not been well managed and it seems that there is a process of modernization, in many cases disproportionate. There are significant differences between the economies of Greece and Italy, for example in the area of competitiveness.

Argentina followed the cutbacks in the 1990s until you took office. These programmes were carried out in exchange for financing in order to be able to pay interest on the debt. You carried out another strategy. What tests did you run then?

The analysis is based on the knowledge of reality. Proposing further cuts in this difficult economic situation, as the International Monetary Fund (IMF) did, was so ridiculous, that I decided that another path had to be taken. Previous governments negotiated credits with the IMF and soon we were in the midst of the crisis. What was the logic of the IMF? “Yes, OK, cutting programs have been carried out, but they need stronger to achieve success.” The programmes did not fail because they were inadequate, but because they were not hard enough. Therefore, as if it were not enough, each programme was harder than the previous one. According to this logic, the country must obtain a surplus in order to be able to pay interest to credit providers. It may be an appropriate approach under normal conditions, but in the situation that Argentina lived or lived in Greece for two years, it makes no sense.

Was the decision to discard the possibility of cuts supported by the government or were there more obstacles?

The problems of the last 40 years in Argentina are due, in part, to the most extreme positions. There have been military or civil governments, also right-wing and pseudo-left-wing populism. The populists wanted to put in place a police system to control prices. The right demanded that the State take over the debts of the banks. In the end, banks were told that the responsibility for debts was theirs and the populists were expelled from the government.

You had to negotiate with the credit providers, with the international financial institutions. They had already planned another adjustment plan, hadn't they?

The international financial institutions already had a loan of between 20 and 25 billion dollars for Argentina. They wanted to avoid the default situation, they didn't want Argentina to suspend payments. On the other hand, the granting of this credit required the implementation of a new cutback plan. Plans for cutbacks such as those we see today in some European states. The Argentine Government had to give these institutions the country ' s economic policy in order to obtain such support. I left all the requests for credit and told them no, that only Argentina would come out of that situation. Of course, our ability to pay interest to credit providers was going to be much smaller, and that worried them. I had to repeat the decision three times. They didn't expect it at all.

Argentina stopped paying the debt and negotiated in 2003 with the main international financial institutions a restructuring of the Spanish sovereign debt. How about when you told credit providers that they would stop paying the debt?

They didn't like it! On the other hand, populism celebrated default and the situation at default is always the proof of defeat, it is not an event that can be celebrated. You have to think about how you can fix it. The right started to insult her. Argentina was compared with Zambia and Eritrea. All States have done so. Taking the most important study on debt, it is observed that Spain, Germany and France have had more default than Argentina. I'm not saying myself, but I was the chief economist at the World Bank, Carmen Reinhart.

Argentina managed, therefore, to get out of the crisis without external financing. What resources was available to the State to move forward?

When it failed to meet the private sector debt interest, some resources were released for other purposes. On the other hand, the priority was the recovery of production. We wanted to launch a beneficial spiral. If production increases, the money raised by the state also increases.

How did production recover?

In the case of Argentina, we have achieved this in several ways. One of the ways was the devaluation of the currency. In the economy, when the currency is devalued and inflation is controlled, a price list is obtained that encourages local production and exports and increases imports. In this way, competitiveness is achieved.

On the other hand, we increased public spending and a comprehensive social plan was put in place. The World Bank indicated that this was the most ambitious social plan so far and that state aid amounted to 2,200,000 families. If we complied with what the banks were asking for, we would have no money for it.

As a result, demand is growing, helping production and putting in place a beneficial spiral. Wages begin to improve, the social situation begins to balance the fiscal balance of the state, increases consumption and as the market increases the country becomes more and more interesting for investments, investments arrive…

If the weight remained tied to the dollar, it could not be devalued. It was therefore important to recover one's own monetary policy.

Yes, of course. Monetary and fiscal policy. In fact, the advice given by the IMF to achieve the surplus had nothing to do with production or economic recovery. How the account was distributed to the IMF. distribution for and against the public of banks and credit providers; That is why salaries were reduced by 13%, pensions and pensions were reduced and workers from the previous programmes were dismissed. As in Greece. What is the case with Greece? Salaries have been reduced by 14 per cent, instead of the 13 per cent so far. You added a point. 100,000 public employees on the street… The programs are always like this and almost always fail.

Is the euro an obstacle to Greece’s economic recovery?

It's all about time. There are two ways in which Greece can regain its competitiveness. The long road can last up to 10 years or more and requires funding from the Greeks during that time. If Greece does its obligations well, if it invests its funding in science, education, technology and infrastructure, competitiveness will be improved. But I do not see Europeans very willing to fund the Greeks for 10 years. In any case, it is technically possible.

The short road is that of devaluation, without leaving the euro completely. In other words, you can create a national currency, return to the drachma for all operations within the country and continue in the euro for all other operations. Of course, inflation should be controlled, but it is feasible.

What lessons can be drawn from the crisis in Argentina?

First of all, cutting policies fail. Secondly, under certain conditions and on the basis of a level of debt there is no alternative but to restructure the debt. For example, if in the case of Greece the debt had been negotiated two years ago, let us say 50 years, and if a low interest rate had been applied to the Japanese (interest of 0.1%), the debt pressure would have been reduced in the budgets. They did just the opposite.

Lately, terms such as “finan dictatorship” or “zorkrazia” are on their lips. Do you think that these are appropriate words to describe the situation we are experiencing?

What is the reality? 40-50 years ago there was a sphere of production – industry, agriculture, trade, etc. – and in some way a financial sphere at the service of the former. Both were areas of similar size or with a ratio of up to 2:1 in favour of the financial. What has happened in the last 40 years has been the growth of the financial sphere and today it is much larger than the sphere of production. There has been a dematerialisation of yields. Today, performance is not achieved with the production of cups or potatoes, it is achieved by moving papers that have no real value, as we saw in 2008. We are dealing here with a financial sector of an excessive size which, moreover, behaves in an uncontrolled manner.

So how can we control the financial sector?

The political world should set the maximum size of finances, as well as the measures relating to the amount of capital they should have. In addition, a financial transaction tax must be created, as recommended years ago by the Nobel laureate James Tobin. The financial sphere should not be completely separated from the sphere of production and the benefits of the world economy should not only come from the “financial casino”, but also be generated in part of the real economy.

Wikipedian bilatu dut hitza, eta honela ulertu dut irakurritakoa: errealitatea arrazionalizatzeko metodologia da burokrazia, errealitatea ulergarriago egingo duten kontzeptuetara murrizteko bidean. Errealitatea bera ulertzeko eta kontrolatzeko helburua du, beraz.

Munduko... [+]

Gasteizko Errotako (Koroatze) auzoan izan diren manifestazio "anonimoek" kolokan jarri dute auzokoen arteko elkarbizitza. Azalera atera dituzte ere hauetan parte hartu duten partidu politiko batzuen eta beste kide batzuen izaera faxista eta arrazista.

In this frenetic and vertiginous world in which we live, the social changes that take place little by little seem to us to be sometimes imperceptible, irrelevant or insignificant. That is not the case, however, and we have to be aware of it in order to act wisely. An example of... [+]

.jpeg)