Fourth year of crisis and Spain at the door of the rescue

- The Social Democrat Zapatero falls the state deficit in the Constitution itself, the Conservative Sarkozy announces taxes for the wealthiest... Do you know what the authorities want, or what they can do, to get your country out of the serious crisis? Dogmas have disappeared since 2007, classic responses have been exhausted, and fear is gradually losing ground.

“What does Zapatero know?” the well-informed journalist Ernesto Ekaizer in the Public Journal asked at the end of August. “Because,” he continues in his article The Stolen Letter, the impressive change of opinion on the constitutional reform of the fiscal deficit in Spain, shows that our great timonel has seen the top of Mount Glaciar and believed that more gestures had to be made to avoid it.”

Summer 2011 has brought a bitter gift to the people of Spain: Like Portugal, it forgets much more closely the need to call for a rescue from Europe. Not only because the interests of the state's public debt have exceeded the worst dreams, but the very adaptation of the debts of banks and savings banks that they supposedly seem to be resolving now is again pending.

The few Basques who are lucky or unfortunate enough to see from time to time the French television channels would not be too surprised. In the same month of April, while debating in a public channel, the economist Jacques Sapir said in a nutshell that Spain was going to ask Europe for rescue in October. The Basque in the South must acknowledge this.

But history will not remember August 2011 because of the anguish of Spain, let alone the fact that Zapatero and Rajoy made their remoteness a consensus between presses and nostalgia. Much more serious has been the extreme of the world's stock exchanges: in the first fifteen days, Madrid has lost 18%, New York 8%... Anyone who does not play money on the stock market would care nothing, unless it is a worsening of the general situation. This is an earthquake similar to the sinking of Lehman Brothers, which in 2008 marked the first great moment of the economic crisis.

Where are we now? Since we are in a situation parallel to the crisis that began in 1929 and spanned the entire 1930s, many have compared 2008 to 1929. In 2011, however, Joaquín Estefanía, who summarized the opinion of the Social Democrats of Spain and of Europe, who led the Madrilenian El País, believed that the developed countries are at a point similar to the one they were in 1937.

In the 1930s, President Roosevelt launched the famous New Deal program, as proposed today by economist Keynes, praised as a godfather by the Social Democrats, to get the economy out of the coma with great public investment. The thing is, in 1937, believing things were pretty straightforward, Roosevelt interrupted public incentives, and to realize they were already in a second recession.

On this occasion, the life of Keynesianism has been much shorter, only between 2008 and 2009. Then, despite the fact that the Social Democrats and Liberals of the world waited and proclaimed the opposite, neoliberal orthodoxy has once again taken over everything.

The Great Depression did not end in the United States of America in II. During the World War. Estefanía did not reassure us when she chose these words from Keynes: “To carry out a great experiment that would prove that my arguments are correct, in a capitalist democracy it seems politically impossible to organize public spending on a sufficient scale if it is not in the conditions generated by a war.”

Well, the end

Leftist economist Michel Husson has recently published A Bottomless Crisis in the journal Viento Sur. According to Husson, this summer capitalism has been shaken by two major crises: The debts of the European states, on the one hand, the debates and doubts about the US debt capacity. The fact that the economy is falling so far shows that the crisis that began in 2007 and that started in 2008 is far from over.

Why? As Jorge Blazquez has published in El País, before our eyes we are seeing the end of a model of global growth. Blázquez, who is president of CORES, an entity that manages strategic oil reserves in Spain, has few reasons to be left-wing. Very graphically, Blázquez has summarized the irreparable dilemma that developed countries have today in reactivating the economy.

The truth is that in the last decade the advanced countries have grown little, only 1.9% a year, while those that grow – the “emerging” ones – have grown 6.2%. Despite their low growth, developed countries have moved the heat of emerging countries. How? Consuming in debt.

In recent years, families in Europe and North America have been able to consume a lot, importing more and more products from abroad, thanks to their seemingly limitless debt capacity. In return, citizens of developing countries had to produce for export and finance the debts of Europe and North America with their savings.

This development model ran out in 2008, according to Blázquez. When the tendency to buy citizenship began to slow down, governments put in place economic promotion measures: to facilitate consumption, to strengthen public works... The operation didn't last long. Then the authorities began mercilessly on the opposite path: cutting public spending, destroying the progress of the welfare society, destroying workers' rights... To the extent that States refuse to indebtedness in their legislation.

“In the last decade – Jorge Blázquez has finished – we have lived in a globalised economy, where developing countries put growth and financing, and developed consumption and debt. The financial crisis has shown that this model has come to an end. But once the shadows of this crisis fade, the question is: Which growth model will prevail and which sectors and countries will emerge winners in the new situation?”

However, to say “when the shadows of the crisis have eased” is an attitude of speaking, to which no one sees an end. The leader of the attac alterglobalist organization, Eric Toussaint, has said that the crisis lasts for one or two decades. Others do similar calculations on the left. Immanuel Wallerstein, professor at Yale University in the United States, says: “Worldwide, there are times of drift and chaos.”

On the contrary, also from the left, the Brazilian Theotonio dos Santos has responded that we have not yet seen the crisis, because, seen worldwide, the economy continues to grow. The real crisis will be known in ten years' time, when the time comes to change the technological model. “The crisis these days will then seem like a joke to us.”

Joking this time? See how the Spaniards, among them the Basques, go through the harsh winter 2011-2012.

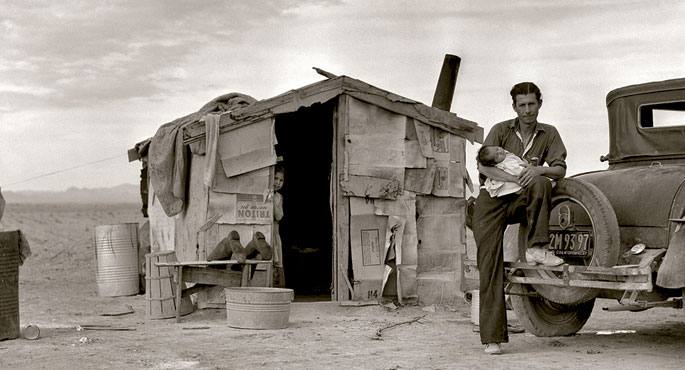

Dorothea Lange argazkilariak erretratu gogoangarrietan bildu zituen AEBetan 1930eko hamarkadan krisiaren atzaparretan harrapatutako jendeak. Interneten Flores y Palabras blogak ipini duen honetan, Imperial Valleyko familia bat ageri da, 1937an. Urte horretan eten zituen Roosevelt presidenteak ekonomia mugiarazteko pizgarriak, krisiaren eraginak gaindituta zeudelakoan, eta bigarren atzeraldia sortu zuen. Keynes ekonomialariak orduan irakatsitakoak XXI. mendean ere baliagarri zirela zioten askok, batik bat sozialdemokratek, Lehman Brothersen porrotak eragindako lurrikararen ostean. Baina laster, munduko ekonomian nagusi diren finantza buruek, beren etekinak atxikitzea lehentasun hartuta, berriro politika neoliberalak ezarri dituzte denetan, orain arte egindako galera guztiak herritarrek pagatuko dituztelakoan.

Until now we have believed that those in charge of copying books during the Middle Ages and before the printing press was opened were men, specifically monks of monasteries.

But a group of researchers from the University of Bergen, Norway, concludes that women also worked as... [+]

Florentzia, 1886. Carlo Collodi Le avventure de Pinocchio eleberri ezagunaren egileak zera idatzi zuen pizzari buruz: “Labean txigortutako ogi orea, gainean eskura dagoen edozer gauzaz egindako saltsa duena”. Pizza hark “zikinkeria konplexu tankera” zuela... [+]

Aposapo + Mäte + Daño Dolor

When: April 5th.

In which: In the Youth Center of Markina-Xemein.

---------------------------------------------------------

I’ve made my way to the cheese house with the shopping cart full of vegetables, and we’ve spent the evening cutting... [+]