Raising interest rates: "It can increase unemployment, but we will do what we have to do"

- The ECB raises interest rates to 2%. In the last few months, for the third time in a row, it has made a huge climb to combat inflation. But this, besides affecting mortgages and citizens’ pockets, can lead to an economic recession for many experts and further unemployment.

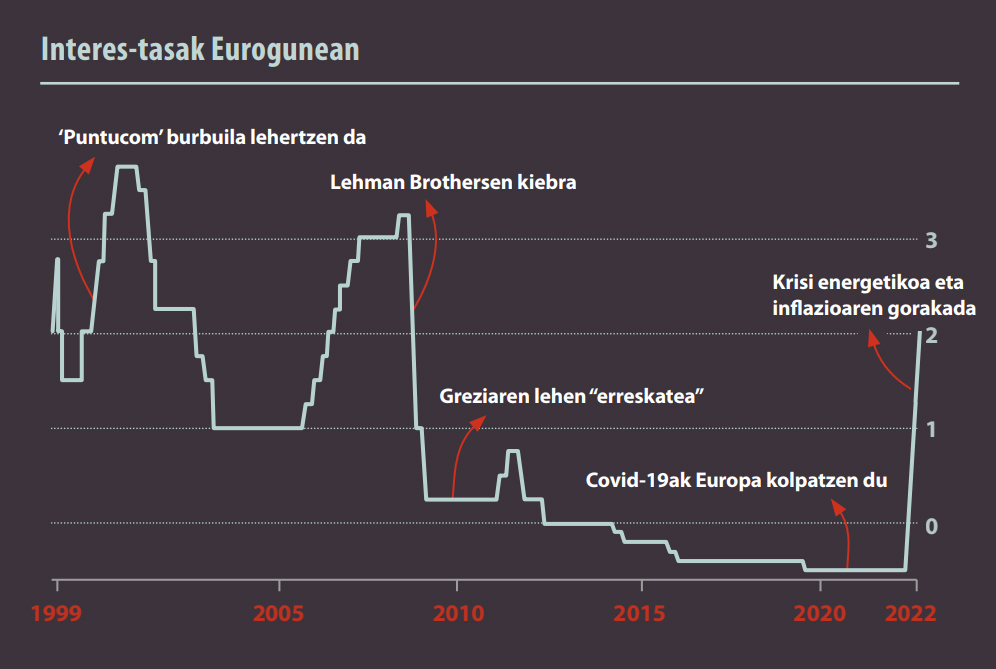

Christine Lagarde, the leader of the European Central Bank (ECB), announced on Thursday that interest rates will increase by 0.75% and by 2%. Frankfurt has placed the price of money in the highest position since 2009, and states that it is to deal with inflation that is recently well above.

Lagard explains that they will continue along the same lines and will see "meeting to meeting" if interest rates continue to rise. The President of the ECB remembers his mandate: Price stability. Thus, he says that until inflation is 2%, they will continue with the same policy, a percentage that today multiplies by five.

Lagard recognised that rising interest rates could harm the economy and create a risk of recession, which could mean "more unemployment in the future, but we will do what we have to do," he said.

Rising interest rates will directly affect citizens with a mortgage, as banks will raise the Euribor rate at the expense of citizens. Only in the Spanish State will almost EUR 15 billion pass from the pockets of citizens to the bank coffers, as we explained in this article.

Economists love the charts that represent the behaviors of the markets, which are curves. I was struck by the analogy of author Cory Doctorow in the article “The future of Amazon coders is the present of Amazon warehouse workers” on the Pluralistic website. He researches the... [+]