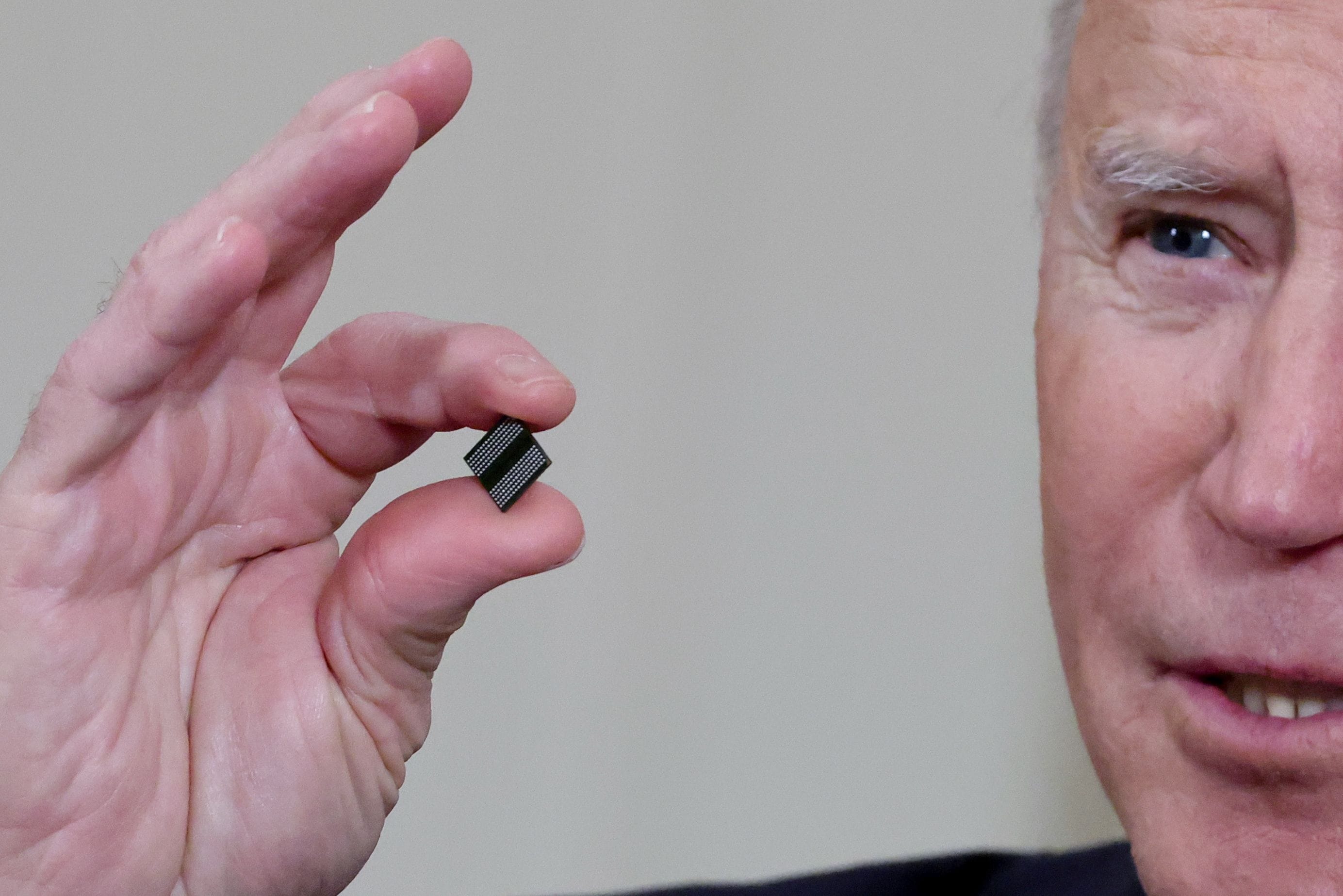

Brussels wants to boost the production of semiconductor chips through state aid

- European Vice-President for Competitiveness, Margrethe Vestager, today announced that states will review the European Union’s competition policy to help finance microchip production.

The automotive sector could have a loss of EUR 180 billion in Europe due to the lack of microchip semiconductor, according to some estimates. In the Basque Country there is also a lack of supplies, especially at the moment in the major automotive factories, such as the Mercedes-Benz of Vitoria-Gasteiz, which will paralyse the last week of December, with the costs of 5,000 employees.

However, the scarcity of these small devices has also influenced the most diverse production chains and the European Commission has considered it necessary to have a “sustainable and secure supply”, given the situation of “exceptionality” that has been created and the forecast that demand for microchips will grow “exponentially” in the future.

It is therefore a question of the Member States being able to support this production with public money, something which is unusual in the context of the competition policy of the European Community economy. Commissioner for Competition of the European Commission, Margrethe Vestager, explained that, however, they will not be "a blank cheque" and will be able to "punish inappropriate behaviour" by companies or "comply with agreements". Furthermore, this aid could be used not only for the production of chips, but also for research and development.

In this context, the two major European engineering companies, German Siemens and French Alston, and representatives of both countries, have called for European competition policy to be more flexible in order to merge these multinationals and deal with the world’s “giants”. For the time being, Vestager has not responded. However, there are not many who are seeing the end of European neoliberal orthodoxy and the principles of competition in this political change. The paradigm shift in the global economy, accelerated by the pandemic, has also reached Europe.

The European Commission’s objective is to produce 20% of the world’s microchip by 2030 in Europe, that is to say twice as much as the current one. To this end, Brussels envisages the construction of large factories and multinationals such as Bosch, Intel and others have been interested in investing millions, the last of EUR 80 billion in a decade.

But it's not going to be easy for you. Growth in the sector in several Asian countries since the 1990s means that Taiwan, South Korea and China are now the main producers of semiconductor chips and in these countries also continue to make millionaire investments – only South Korea will provide EUR 400,000 million. In the United States, microchip production has also become a topic of "national security" and gigantic factories are already being built in the State of Arizona with direct public funding (€52 billion) and, according to Reuters, aid with a tax credit of 25% is also being studied.

The balancing exercise between public aid and Vestager’s competition is not straightforward, as the global crisis has brought neo-liberalism to its knees.

2021etik 2025era isuriak %15ean murriztu behar zituen industriak. Ursula Von Der Leyenek automobilgintzaren sektorearen eskutik ekintza plan bat aurkeztuko du martxoaren 5ean. Oraindik erabakia hartua ez badago ere, Europar Batasunak sektorearen eskaerak onartuko dituela diote... [+]

The devastating characteristics of today ' s global world, wars, ecological and social injustices herald an apocalyptic representation of the future anywhere on the planet. Echoes of the nuclear threat further dispel the concern of fear and concern, while politicians... [+]

The effective tax rate that Amazon paid in the last decade was 13 percent. By 2020, the 55 largest companies in the United States did not pay taxes. The effective rate on the profit of companies that in the Spanish state invoiced more than one billion euros was 4.57% in 2019... [+]