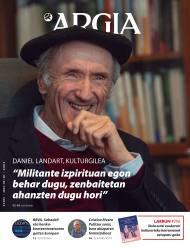

Banks hunger: who makes the beast fat?

- The “aggressive” offer of BBVA to swallow Sabadell has once again shown us the skin of today’s banks. You fall into the clutches of hedge funds like BlackRock, we've long been a shameful organization hunting for them. But not everything is the fault of the shareholders, the decisions taken at the highest levels of policy also have to do with: the European Central Bank has pushed banking concentration beyond gratification.

The BBVA Public Purchasing Offer (EPP) for the acquisition of control of Sabadell has created the noise due to its economic and political dimension. BBVA would become the second largest bank in the Spanish State, only behind the Santander bank, and would be the top ten largest European banks. The main media have taken the lead in analysing the consequences of the so-called opilla (impulsive PPE), which without the consent of the company management directly proposed the trade to the shareholders, and have led their hands to the head, as the citizen mortgage and the credits of the companies would be handled by a few incandescent.

But the banking concentration is not something sent from the sky by San Pedro, but it is a beast that since the crisis of 2008 is becoming fatter in Europe.

BBVA received its wings from Bilbao and Vizcaya to wider business niches in Madrid and internationally, scarcely leaving its social headquarters in our lands, as a symbolic witness to the Basque roots of Neguri. In the case of Sabadell, the referendum on 1 October 2017 changed its registered office to Alicante, which won 6% on the stock market, but it seems that it is more linked to companies in the Catalan countries, which has made the victim of this film into a chinche, even though the catches he has eaten on his way are not much less.

.jpg)

The impact that BBVA has had in Euskal Herria has nothing to do with the attention that the media of the Catalan countries have given to the issue. It is not easy to know why BBVA announced its intention to buy Sabadell on the eve of the Catalan elections, but this has accused all parties, employers and governments of the operation.

At Vilaweb we can read a harsh editorial by director Vicent Partal. The complaints of Josep Oliu, head of Sabadell, are “crocodile cynical tears”, according to Partal, moving his attitude with the referendum to the quotation, and is surprised by the homogeneous discourse that has been opened from Junts to the PP to protect the Alicante bank.

In the same digital newspaper, Di Goula, a veteran journalist and economist with extensive experience in La Joroba, has published an analysis with the military title El BBVA treu l’artilleria pesant (BBVA has pulled out heavy artillery): “It is clear that it is a turning point in the financial world”, he acknowledged, but has not made clareté in the shareholders. 90% of Sabadell’s shares are free float in finance jargon, that is, they are not controlled – although many are in the hands of BlackRock, Vanguard, Norges… – and no one knows if those shareholders willing to receive a strong free loving hug to earn four money on the stock market.

The ECB’s response has been a great mutis. What else could one expect from an organization that applauds the creation and merger of giant banks?

Attention, systemic risk

The banking concentration that would result from the purchase of Sabadell is not surprising to some. One of them is Joan Ramón Sanchís, director of the Chair of Economics for Social Welfare at the University of Valencia and author of eleven critical books on financial institutions, among them is it possible a world without banks? (Is a world without banks possible? ).

Sanchís has been warning for years about the social risks of the process of fusion and fattening of banks that is happening. In his Parlem d’Economia channel on Youtube, in an eight-minute video recorded in the bedroom of the house, he clearly summarizes, for the humble streets, the damage that the merger between BBVA and Sabadell would cause: “I am boring, boring at all, because I have spoken for many years about the serious consequences that the mergers of the big banks, which the economist has complained about. Bank mergers have long been carried out, which has had very negative effects, such as customer abuse, but no one has opposed it.” The anguish generated by BBVA’s PPE to Sabadell has now become curious.

Sanchís says that mergers diminish competition between banks, but above all he has to alert us to the “systemic risk” that this causes: “The bank becomes so big that when a crisis occurs you cannot drop and you have to inject public money.” As in 2008. Then, the state increases public debt because it says that it “has an obligation” to finance bank losses – because it wants to socialize – and of course, the beast’s mouth devours all the money it was to maintain public services.

With the merger, banks tighten credit and mortgage conditions. Where does that take us? In a word no, but in three: commissions, abuses, fraud

Another issue that can affect citizens is the duplication of branches. We also learned very well what is behind euphemisms such as the “restructuring” of the banking team with the 2008 crisis, but just in case Sanchís reminds us: “closing offices and destroying jobs”.

In addition, concentration increases the power of banks: “Their trading capacity increases with the customer and they can use financial exclusion,” he says. Small businesses have greater difficulties in obtaining credit, and banks also tighten the conditions for family mortgages, etc. Where does that take us? In a word no, but in three: committees, abuses, fraud.

Champions praying

Spanish Minister of Economy, Carlos Body, travelled to Brussels after the launch of the EEP against Sabadell by BBVA. The Minister explained to the Head of Inspectors of the European Central Bank (ECB) the “concerns” raised by the banking concentration on the Government of Spain. It does not seem that the citizens' mortgage or the conditions of the cashier's employee prevent him from sleeping more than political calculations.

.jpg)

The ECB’s response is a great mutis. What more could one expect from an organization that attentively applauds the creation of giant banks? The ECB’s technical regulators believe that banks should have sufficient solvency to withstand a crisis.

Frankfurt has been promoting banking convergence for years, and better if they are cross-border, in creating “European champions”. In finance, energy, telecommunications, even in microchip generation mega-workshops, the idea is that the European Union needs food corporations to compete in parallel with the global powers. Urinate further.

Spain is at the forefront of the cart of banking concentration – in 2008 there were 55 banks across the state, fifteen years later, only 9 – and they go further behind. In the French state, for example, rumors about the wedding between the giants BNP and Société Génerale have not been silenced. Of the 100 largest banks in the world, 37 are on this continent.

In the last financial crisis, the global phenomenon too big to fail (too big to drop it) preceded the savings of citizens and the last cents of public coffers. But the authorities have not learned much from this cataclysm, even as soon as.

Beste alternatiba batzuk badaudela aldarrikatzen dute zor bidegabea abolitzeko sare herritarrek edo finantza etikoen inguruko elkarteek. Ez gara hemen hasiko finantza zerbitzu kooperatiba eraldatzaile bat zer den azaltzen, horretarako irakurleak nahikoa luke Koop57ri buruzko ARGIAren kanalera sartzea. Banku etikoak ere badaude, gurean Fiare eta La Nef dira ezagunenetakoak.

.jpg)

Baina seguruenik, banku publikoak dira historia luzeena eta esperientzia handiena dutenak –Euskal Herrian aurrezki kutxak ziren gisan, banku-fundazio bilakatu eta kontrol soziopolitikorik gabeko patronatuen esku utzi zituzten arte–. Europan eta mundu zabalean banku publikoen eredu asko daude, eta adibide bitxiena dolarraren paradisuan aurkitu dezakegu, AEBen Midwest-ean, Ipar Dakotan.

1919an nekazari mugimendu zabal batek sortua, Bank of North Dakotak AEBetako populismoan du jatorria –populismoa ezkerreko aldarrikapena zen garaian–, Thomas Frank historialariak Jacobin-eko elkarrizketa batean azaldu duen gisan. AEBetako aldizkari ezkertiar horretan bertan aurkitu dugu bankuaren historiari buruzko informazio xehea dakarren beste artikulu bat, Michael Lansing-ek idatzia: North Dakota has the country’s oldest Public Bank. We should look to it as a model (North Dakotak herrialdeko banku publiko zaharrena du. Eredu bezala hartu beharko genuke)

Lansingek dio bankua sortu zela zerealekin zeuden praktika predatzaileei jatorri ugaritako nekazari migratzaileek emandako erantzun gisa. Garia Minneapolisera bidali eta bueltan apenas zetorkien ezer. NPL (Liga ez Alderdikoia) izeneko plataforma sortu zuten lehenik, eta hortik botere gehiago lortu eta enpresa handiekiko alternatiba publikoak eraikitzen hasi ziren: estatuaren jabetzako ale igogailu bat, irin-errota bat… eta bankua. Ipar Dakotakoa ez zen lehen estatu-bankua izan, “baina jendeari finantza zerbitzuak emateko behetik goranzko mugimendu batetik sorturiko halako erakunde batek bide berriak ireki zituen”, dio Jacobin-eko artikulugileak.

1929ko krakean, nekazariak milioika dolarreko kredituekin lagundu zituen Bank of North Dakotak. Bigarren Mundu Gerraren ostean estatuaren funtsak hornitu zituen, geroago, milaka ikasleri mailegu merkeak eman zizkien unibertsitatera joan zitezen, eta 1980ko hamarkadako nekazal krisian, tokiko garapenerako proiektu ugari babestu zituen.

Ipar Dakota AEBetako estatu aberatsenetako bat da egun, eta hein handi batean banku publikoak zerikusia du horrekin. Baina dena ez da lausengu: Ipar Dakota errepublikarren gotorleku bihurtu da eta banku publikoak norabide kezkagarria hartu duela dio Lansingek. Esaterako, Standing Rockeko Dakota Access oliobidearen kontrako protestetan, jatorrizko herriak zapaltzeko urgentziazko maileguak eman zizkien agintariei, poliziak eta mertzenarioak ordaintzeko dirua eduki zezaten. Kontuz beraz, ez daigun piztia ardi narruz mozorrotuta etxera sartzen utzi.

Iruñean bizi ziren Iñaki Zoko Lamarka eta Andoni Arizkuren Eseberri gazteak, baina familiaren herriarekin, Otsagabiarekin, lotura estua zuten biek betidanik. “Lehen, asteburuetan eta udan etortzen ginen eta duela urte batzuk bizitzera etorri ginen”, dio... [+]

Europar Kontseiluak onartu du Ursula Von der Leyenek gastu militarrean proposatu duen 800.000 milioi euroko gastuarekin aurrera egitea. Horretarako bi arrazoi nagusi argudiatu ditu: Errusiari aurrea egitea eta Europar Batasunak aurrerantzean bere burua AEBen babes militarrik... [+]

Laudion, Aiaran eta Okondon izango du eragina energia azpiegiturak eta plataformaren aburuz, proiektuak eta ingurumen-inpaktuaren azterketak gabezia garrantzitsuak dituzte.

Nahiz eta Nazio Batuen Erakundeak (NBE) 1977an nazioarteko egun bat bezala deklaratu zuen eta haren jatorriaren hipotesi ezberdinak diren, Martxoaren 8aren iturria berez emazte langileen mugimenduari lotua da.

Lan baldintzen "prekarietatea" salatzeko kontzentrazioa egin zuten asteartean egunkariaren egoitzaren aurrean. Abenduaren 2tik sindaura greban daude langileak eta mobizlizazioak "areagotzea" erabaki dute orain.

Gasteizko Eraman kooperatibak banaketa “era jasangarri eta etikoan” eginez bertako komertzioa bultzatzeko helburua du bere sorreratik, Arabako hiriburuan eta hango bizilagunengan pentsatuta. Hainbat ekimenetan parte hartzen du, horien artean ikasturte honetan egiten... [+]

Langileek salatu dute zuzendaritzak ez diela lan baldintzen gaiari heldu nahi izan eta enpresak nahiago izan duela Gaztea Sariak ekitaldia bertan behera utzi, “horrek sortutako albo-kalte ekonomiko eta sozial guztiekin”, arazoari irtenbidea eman baino.

Datorren astelehenean egingo dute espedientearen kontsulta epeko bigarren bilera.

Sustatun agertutako salaketa, LaLiga futbol erakunde espainiarraren eta Movistar/Telefonicaren arteko tratuek euskarazko zerbitzuak kaltetzen dituztela Interneten (kasu hartan Egunean Behin jokoan irudiak desagertzea zen kontua), hedatu egin da. Tokikom-eko euskarazko tokiko... [+]

Ursula Von der Leyen Europako Batzordeko presidenteak Europa berrarmatu plana aurkeztu du, kontinentea "erresilientea eta segurua" bihurtzea xede duena. Bost zati ditu planak, eta estatu kideek 150.000 milioi euro jasoko dituzte mailegutan. Arau fiskalak moldatuko... [+]

2021etik 2025era isuriak %15ean murriztu behar zituen industriak. Ursula Von Der Leyenek automobilgintzaren sektorearen eskutik ekintza plan bat aurkeztuko du martxoaren 5ean. Oraindik erabakia hartua ez badago ere, Europar Batasunak sektorearen eskaerak onartuko dituela diote... [+]

Betsaide enpresan gertatu da, 08:00ak aldera. Urtea hasi denetik gutxienez bederatzi behargin hil dira.

Agintari gutxik aitortzen dute publikoki, disimulurik eta konplexurik gabe, multinazional kutsatzaileen alde daudela. Nahiago izaten dute enpresa horien aurpegi berdea babestu, “planetaren alde” lan egiten ari direla harro azpimarratu, eta kutsadura eta marroiz... [+]

Mendizale batek asteburuan ikusi du animalia Lapurdiko Azkaine herrian, eta otsoa dela baieztatu du Pirinio Atlantikoetako Prefeturak. ELB lurraldean "harraparien presentziaren kontra" agertu da.

2024ko laneko ezbeharren txostena aurkeztu dute LAB • ESK • STEILAS • EHNE-etxalde eta HIRU sindikatuek aurtengo otsailean. Emaitza larriak bildu dituzte: geroz eta behargin gehiago hiltzen dira haien lanpostuetan.