- Inflation in February rose to 6.1% in Hego Euskal Herria and the underlying inflation to 7.7%. To curb price increases, raising interest rates and reducing demand is the norm of ordoliberalism. But to what extent is inflation accurate?

On Tuesday, the National Institute of Statistics (INE) released data on inflation in the Spanish State, and although the National Institute of Statistics (INE) will be issued in two weeks, this advance serves to predict that prices will rise again.

Inflation has risen from 5.9% to 6.1% and the underlying inflation, a meter that affects the daily basket more, has reached 7%. According to the INE, this increase is due to increased electricity and increased food prices.

Energy costs are rising and companies reflect this on the prices of their products for citizens to pay.

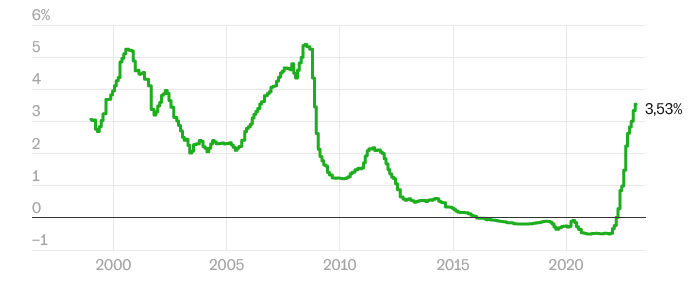

Meanwhile, to combat inflation, the European Central Bank continues to increase interest rates. In March, bank President Von der Leyen announced that he would raise half a point. And the Euribor index continues to grow, therefore, paying the salaries of the mortgage payer every month.

In one year, the mortgage must pay the bank an average of EUR 3,200 more.

But contrary to what this “cooling” formula of the economy says, prices are not falling and inflation cannot be controlled. Why?

Electricity and gas costs are rising. The war in Ukraine, the turbulence of the market… the analysts say. However, when the fall 2021 electricity boom occurred, there was no war, when power companies took advantage of the diffuse regulation of the Spanish state to receive money from the “sky”.

Now, despite the tightening of Spanish regulations and the price cap on the Iberian Peninsula, the energy companies and the investment funds and banks that are part of them are getting the biggest profits in history: Iberdrola, 4,339 million euros; BBVA 6,420 million; Repsol 4,251 million…

Of course, inflation is not an economic device invented for the benefit of some, but nor is it a meteorological phenomenon. It's a meter that sometimes serves to measure retrograde economic policies.