- On the occasion of the meeting of the Basque Finance Council, everyone highlights the greatest revenue in the history of the Basque Country. Where do the Basque haciendas receive that money? Who is paying more and who less in recent years?

Income from employment and the contribution of society (via VAT) account for 88% of total corporate tax revenue. Corporate and capital incomes barely pay 10%.

Income from direct taxes contributes 92%. Corporate and capital incomes account for 6%.

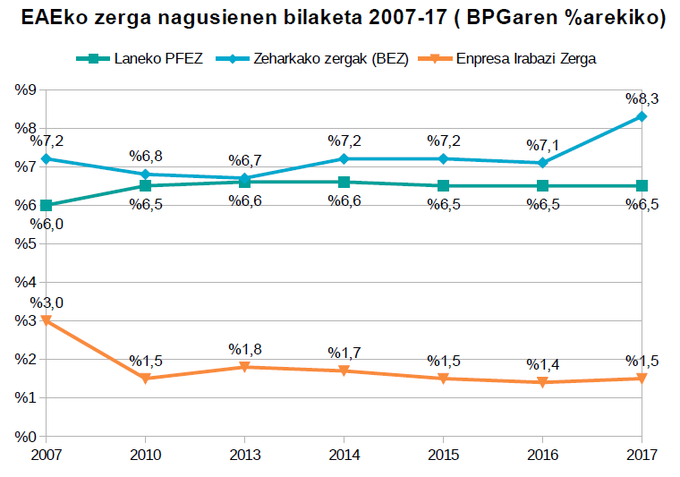

And evolution goes against the working class and the humble citizenship. Income from employment and VAT and decline in Corporate Earnings Tax (located at the last end of Europe along with that of Navarra).

Despite the increase in the wealth generated by the workers, the distribution of this wealth is increasingly unfair.

In addition, within the framework of the spending rule and the deficit ceiling agreed by the Basque institutions with the Spanish State, the additional money obtained from workers' incomes will not go to public or social services but to pay the debt generated by the bank bailout.